Home Loan (New Purchase & Refinancing)

Own your dream home with OCBC Home Loan

- Financing of up to 80% (100% for re-financing cases)

- Attractive interest rates

- Repayment choices to help ease your cash flow

- Fast approval in 30 minutes

- Dedicated customer care officers and mortgage specialists are just a phone call away

3 different packages to suit your needs

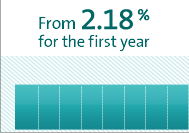

Short-term fixed interest rates

- Fixed monthly payments means you can budget and plan ahead

- Protects you from rate fluctuations for the first 1-2 years

- Interest rates tend to be higher than other packages

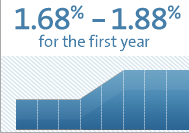

Variable interest rate

- Rates are lower than fixed rates

- Rates and payments can change with the OCBC board rate (unchanged since 2006)

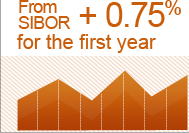

SIBOR-dependent rates

Need help?

Call our mortgage specialists at

1800 438 6088

The interest rates indicated are fixed and guaranteed for either the first year or the first two years only, depending on the package you sign up for.

This will also mean that your monthly instalment is fixed and will not change within those years.

At the end of the fixed rate period, the interest rates will be based on the bank’s internal rates (board rate) minus a discount stated in the Letter of Offer. The board rate has not changed since 2006.

Call our mortgage specialists at 1800 438 6088 to find out the best rates available.

Calculate monthly payments

This will also mean that your monthly instalment is fixed and will not change within those years.

At the end of the fixed rate period, the interest rates will be based on the bank’s internal rates (board rate) minus a discount stated in the Letter of Offer. The board rate has not changed since 2006.

Call our mortgage specialists at 1800 438 6088 to find out the best rates available.

Calculate monthly payments

Customers can choose between different lock-in periods.

The lock-in period indicates the period where there will be penalty imposed on the customers if they decide to refinance the loan. For packages with no lock-in period, the customer can choose to refinance the housing loan package anytime.

Usually the interest rates are lower for packages with longer lock-in period. They range from 1.08% to 1.98%, and will be 3.75% thereafter.

Call our mortgage specialists at 1800 438 6088 to find out the best rates available.

Calculate monthly payments

The lock-in period indicates the period where there will be penalty imposed on the customers if they decide to refinance the loan. For packages with no lock-in period, the customer can choose to refinance the housing loan package anytime.

Usually the interest rates are lower for packages with longer lock-in period. They range from 1.08% to 1.98%, and will be 3.75% thereafter.

Call our mortgage specialists at 1800 438 6088 to find out the best rates available.

Calculate monthly payments

The SIBOR may change every day. The bank uses a SIBOR on a specific date (also known as the rate review date) and adds on a fixed percentage for the interest rates of the housing loan. The interest rate will be reviewed every 3 months.

SIBOR varied from 3.5% to 0.6% in past 5 years.

With the add-on percentage, the interest rates for SIBOR-dependent packages range from 1.16% to 1.56% for the first 3 years.

Call our mortgage specialists at 1800 438 6088 to find out the best rates available.

Calculate monthly payments

SIBOR varied from 3.5% to 0.6% in past 5 years.

With the add-on percentage, the interest rates for SIBOR-dependent packages range from 1.16% to 1.56% for the first 3 years.

Call our mortgage specialists at 1800 438 6088 to find out the best rates available.

Calculate monthly payments

Eligibility

For HDB purchase, you must meet HDB eligibility

Private property

Everyone, including Singapore PRs and foreigners are eligible.

Amount you can borrow

HDB

From S$100,000 to 80% of valuation

Private property

From S$200,000 to 80% of valuation

From S$100,000 to 80% of valuation

Private property

From S$200,000 to 80% of valuation

No comments:

Post a Comment