YSX Business Regulations

Trading Regulations

| Name | Enforcement | Myanmar | English |

| Trading Business Regulations | 30th Oct. 2015 | ||

| Enforcement Regulations for Trading Business Regulations | 21st Dec. 2015 |

Clearing and Settlement Regulations

| Name | Enforcement | Myanmar | English |

| Clearing and Settlement Business Regulations | 24th Mar. 2016 | – – | |

| Enforcement Regulations for Clearing and Settlement Business Regulations | 24th Mar. 2016 | – – | |

| Table of Fees for Clearing and Settlement | 18th Dec. 2015 | – – |

Book-entry transfer Regulations

| Name | Enforcement | Myanmar | English |

| Business Regulations Relating to Book-Entry Transfers of Stock, etc. | 12th Mar. 2016 | – – | |

| Table of Fees for Book-Entry Transfers of Stock, etc. | 16th Dec. 2016 | – – |

Listing Regulations

| Name | Enforcement | Myanmar | English |

| Securities Listing Business Regulations | 4th Apr. 2016 | – – | |

| Enforcement Regulations for Securities Listing Business Regulations | 16th Dec. 2016 | – – | |

| Table of Fees for Listing Company | 18th Dec. 2015 | – – | |

| Listing Criteria | 13th Aug. 2015 |

Trading Participant Regulations

| Name | Enforcement | Myanmar | English |

| Trading Participant Business Regulations | 12th Mar. 2016 | – – | |

| Enforcement Regulations for Trading Participant Business Regulations | 31st Mar. 2016 | – – | |

| Table of Fees for Trading Participant | 18th Dec. 2015 | – – |

Shareholders’ Agency Business Regulations

| Name | Enforcement | Myanmar | English |

| Business Regulations Related to Shareholders’ Agency Business | 16th Dec. 2016 | – – | |

| Table of Fees for Shareholders’ Agency Business | 18th Dec. 2015 | – – |

...

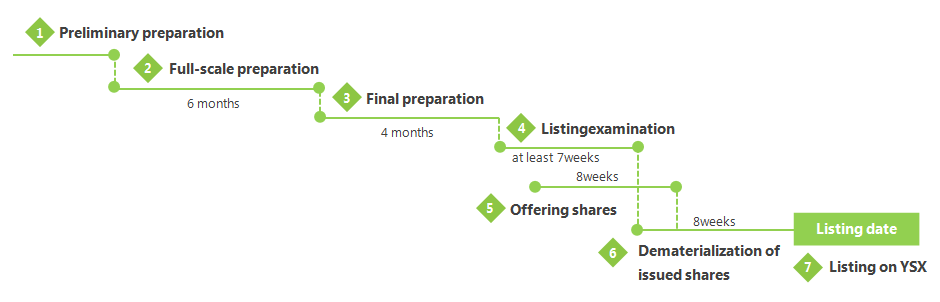

Listing procedure

Listing on YSX takes a 7-step from advance preparation to

listing date and the process takes approximately 1year and 6 months from

Full-scale preparation (2nd step).

Model schedule

(1) Preliminary preparation(until more than 12 months prior to the listing date)

Appointment of internal teams

-

An applicant company establishes internal teams to manage listing preparation.

Appointment of experts

-

Underwriter : To coordinate whole IPO process and underwrite offering shares

-

Accounting consultant : To support preparing financial disclosure documents

-

Independent auditor : To audit financial disclosure documents

-

Public and Investor relation advisor : To build a strategy and guide communications with stakeholders

Fundamental preparation

-

To develop robust financial and business plan

-

To adopt leading practice of corporate governance and reporting process

-

To establish financial reporting procedure and to begin preparation of historical financial information

-

To review and implementcompliance control system

-

To consider and restructure the ownership structure

(2) Full-scale preparation (6 months)

Documentation

-

To finalize summing up historical financial information

-

To commence due diligence by a lead underwriter

-

To prepare prospectus for public offering or disclosure document for listing (DDL)

Company restructuring

-

To start to commence planned financial and business plan

-

To make necessary restructuring of management structure

-

To implement financial reporting procedure

(3) Final preparation (4 months)

Preparation for Listing examination

-

To start financial and legal due diligence

-

To complete drafting the prospectus or DDL and listing application documents

Preparation for offering shares

To prepare road show presentations for targeted potential investors

(4) Listing examination (at least 7 weeks)

Listing application

-

Applicant company prepares all listing application documents and submits to YSX.

| Application document |

Listing examination

-

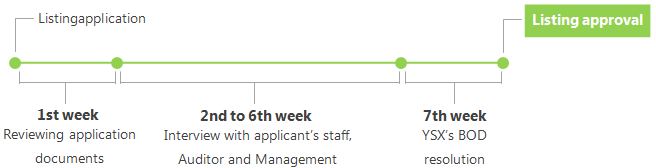

The examination takes at least 7 weeks, in general but the schedule may be extended depending on the company’s situation.

-

Listing examination is conducted through reviewing applied documents, interviewing with staff, Auditor and company’s management and field examination as necessary.

-

YSX judges listing eligibility of a company in terms of meeting the listing criteria such as business and financial soundness, corporate governance and internal management system.

| Listing criteria (English) | |

| (Myanmar) |

Model schedule of the examination (at earliest)

Listing approval

-

YSX makes an announcement of listing approval and a listing date of the applicant on YSX’s website.

(5) Offering shares (8 weeks)

Procedure of offering shares

-

To lodge prospectus with SECM and to receive an approval of offering shares.

-

To offer shares to existing shareholders (rights offering) and general public (public offering) with providing prospectus through underwriter securities companies*.

* Multiple securities companies make up a syndicate group for offering as usual.

(6) Dematerialization of issued shares (8 weeks)

Procedure preparation

-

An applicant company and securities company make necessary arrangements of confirming procedure of dematerialization of the company’s shares.

Opening securities account

-

Existing shareholders of an applicant company make registration of shares into a securities account in a securities company having trading qualification.

-

An applicant company, through securities companies, collects share certificates of existing shareholders who make registration of his/her owning shares into a securities account.

Data verification

An applicant company and securities companies conduct

data verification between the company’s the latest shareholders list and

shareholders data registered in ICT system of securities companies.

Making a special account shareholders list

-

An applicant company makes a special account shareholders list for shareholders who haven’t opened a securities account made registration of owning shares by closing date set by the company.

(7) Listing on YSX

-

An applicant company gets list on YSX on the listing date.

Contact:

Listing & Trading Participant Department

Tel: 01-371274

Email: listingdept@ysx-mm.com

No comments:

Post a Comment