Malaysia’s Stocks Selloff Has Investors Sniffing for Bargains

By

- Country’s stock market capitalization down $33b since election

- Good opportunity to get back into growth proxies: Nikko Asset

A $33 billion selloff in Malaysian stocks since Mahathir Mohamad’s election has got Nikko Asset Management on the hunt for bargains.

Some of the nation’s banks, consumer and healthcare shares have now fallen to attractive levels, according to Kenneth Tang, a fund manager at the $220 billion Japanese investor. Risks over rising interest rates and a global trade war have also been discounted by the recent selling, he added.

“Companies that we have always wanted to own and felt that valuations were the only issue are now coming back in our favor,” Tang said in a recent telephone interview. “This is a good opportunity to get back into some of these growth proxies.”

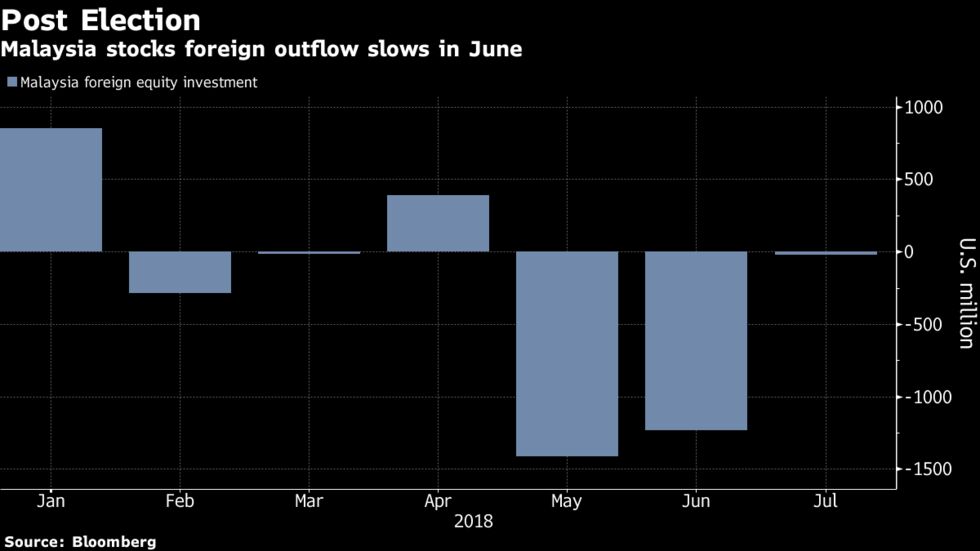

In a one-two punch for Malaysian investors, Mahathir’s surprise election ignited concern about the country’s fiscal policies just as a resurgent dollar and higher U.S. yields sparked a slump in global emerging markets. The benchmark FTSE Bursa Malaysia KLCI Index has fallen about 9 percent since he was sworn in as prime minister on May 10, and foreign investors have withdrawn $1.8 billion from the market so far this year.

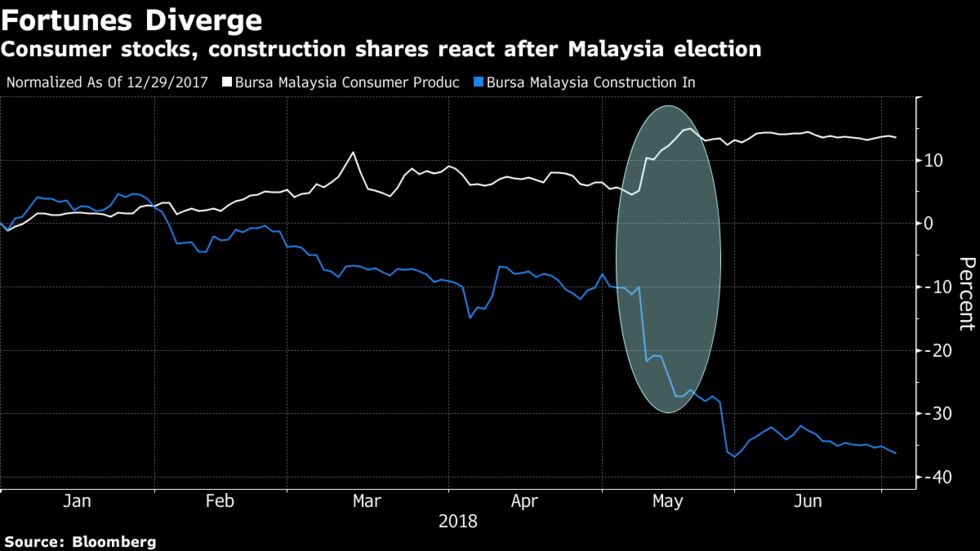

The equity gauge rose 0.1 percent as of 10:12 a.m. in Kuala Lumpur, extending its two-day gain to 0.5 percent. Construction stocks have plunged 28 percent since the election as the government reviews its infrastructure spending.

However, like Nikko, others now believe the declines have gone too far. Jalil Rasheed, a managing director at Invesco Asset Management, says now is a good time for investors to look at domestic-demand plays.

“We are buyers of Malaysia currently as there are pockets of good quality companies trading at attractive valuations,” said Rasheed. “These are companies that are not government linked rather they are mass market consumer companies.”

Consumer firms were among the biggest winners following the new government’s removal of the goods and services tax on June 1, to be replaced with a new sales tax planned for September, according to Mahathir. Nestle Malaysia Bhd. is the top performer in the benchmark since the election with a 43 percent rise and the Bursa Malaysia Consumer Product Index is heading for its best year since 2010.

And for Tushar Mohata, the head of Malaysia research at Nomura Holdings Inc., the country’s banks, which account for 34 percent of the benchmark index, are other obvious beneficiaries of the new government. Public Bank Bhd. and Hong Leong Bank Bhd. are among consumer-focused firms that will benefit from the uptick in consumption, he said.

Still, as the new administration sets its course for reducing government debt and stemming corruption, the uncertainty of whether it will be able to institute reform while meeting fiscal targets is keeping some foreign investors away.

“I don’t know whether they’re ready to give the new administration the benefit of the doubt yet,” said Gerald Ambrose, chief executive officer of Aberdeen Standard Investments Malaysia who helps manage about $3 billion in the country’s equities. “There are so many unanswered questions.”

Lingering Doubts

Toward the end of last month, the cost of insuring Malaysian bonds against default soared past that for India and the Philippines, ranked two levels lower by Moody’s Investors Service. On top of the scrapped goods and services tax, the new government has reinstated fuel subsidies, while Maybank Kim Eng Securities has estimated it may cost as much as $8.6 billion to service state fund 1MDB’s debt from 2019 to 2023.

Nevertheless, there’s also a risk to investors from avoiding the stock market, according to Arthur Kwong, head of Asia Pacific equities at BNP Paribas Asset Management.

“Of course you want more details, you want more clarity, more action,” said Kwong. “The more you see, the more you will be convinced, but the more you see, the more the market has already moved up.”

No comments:

Post a Comment