Is Temasek waiting for Standard Chartered to collapse?

In 2006, Temasek bought 152 million Standard Chartered shares and continued building up its stake to 19% by 2008. Since 2008, Temasek has also subscribed to rights issues between 390 pence and 1280 pence.

The average price of Temasek’s investment is estimated to be 1350 pence. This is because it had bought the bulk of Standchart at prices ranging between 1500 pence and more than 1800 pence from 2006 to 2008.

If Standchart was such a good bet, Temasek would not have been looking to divest since 2012. Unfortunately, due to its ‘concentrated’ position, there has been no buyer for its then £6bn investment. If it had taken a smaller stake instead of risking more than S$10 billion on a single investment, divestment would have been a breeze.

The 438 million Standchart shares owned by Temasek would have cost at least £5.9 billion. At its current share price of 650 pence, it is sitting on an unrealised capital loss of £3.1 billion after 9 years.

Source: Marketwatch.com

Similar to its billion-dollar losses in Barclays PLC and Merrill Lynch, net unrealised losses in Standchart will be just as costly even after taking into account more than 300 pence per share in dividends.

Unlike other about-to-collapse Temasek investments such as Olam, SMRT, etc which had been propped up with billions of our reserves and tax dollars, PAP is unlikely to prop up Standchart with our reserves.

Does Temasek have any plan or is it planning to sit on Standchart for 2 to 3 decades?

PS

There are other long-term underwater investments which have been kept out of the public eye.

One of them is NIB Bank which Temasek invested in 2005 and presently owns 88% of NIB. Temasek is also in trouble with this low profile, almost-S$1 billion investment which has earned next to nothing since 1 decade ago. And EVEN if it manages to get rid of this lousy investment costing taxpayers about $1 billion, it has to take into account the exchange rate which has halved.

Temasek has also been looking to divest NIB since 2011 but who would be interested in a lousy investment?

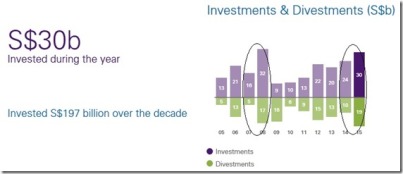

Temasek claimed its investments had recovered but how could it be possible when it divested at depressed prices in 2009 and 2010? Many of its investments were also bought at inflated prices near the market peak in 2007. When prices were depressed between 2009 and 2011, Temasek’s 3 year investments were equivalent to its one year investment in 2008 (see chart below)!

It appears Temasek has been investing heavily at inflated prices. Instead of buying in a lelong sale, Temasek was a net seller. Hmm .. how to make money like that??

Were profits from the sale of national assets included in its returns calculation?

Since our reserves do not belong to the PAP government, it should come clean and publish all relevant information pertaining to Temasek’s investments. Selective disclosure of information will only breed more distrust.

No comments:

Post a Comment