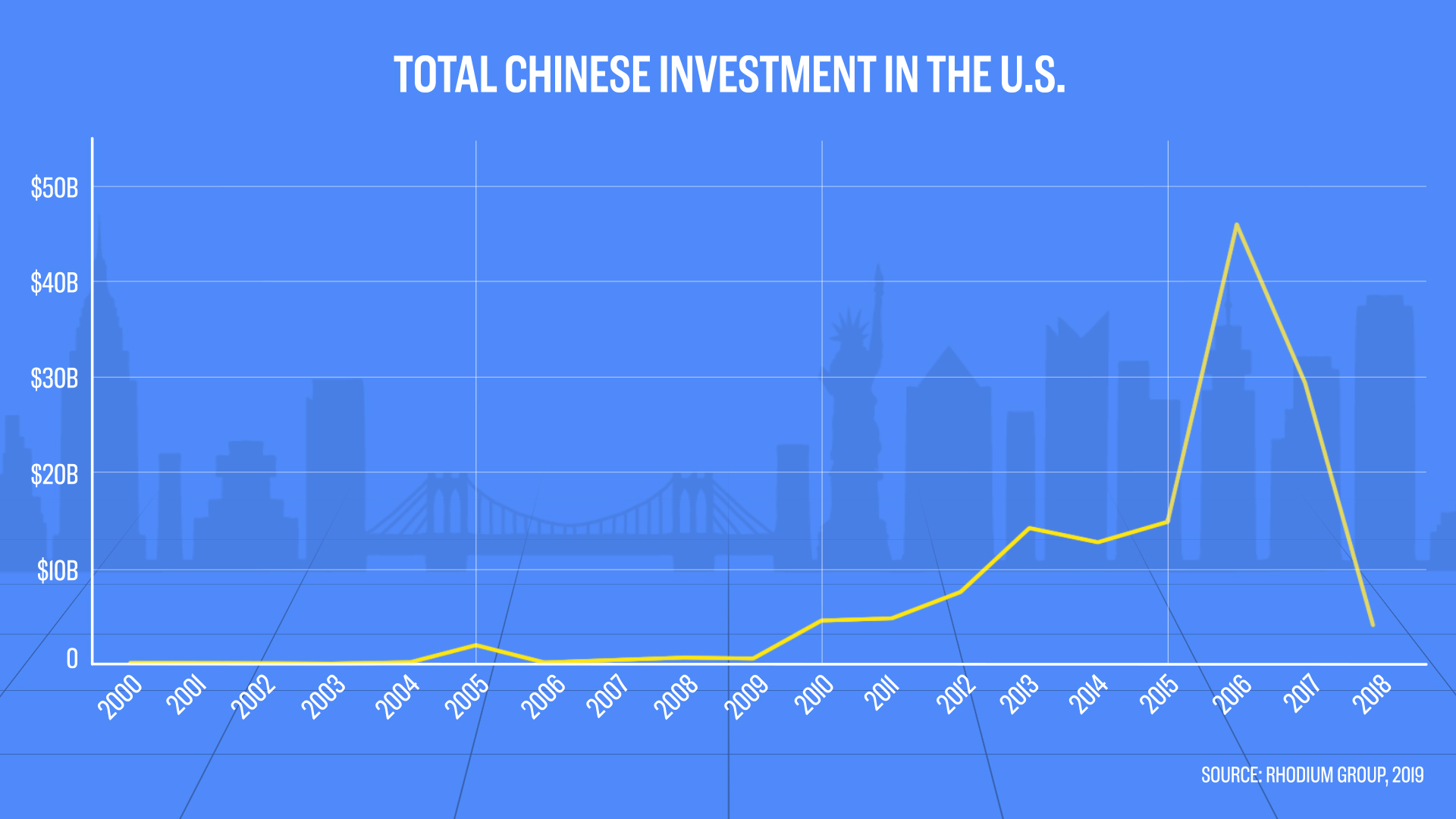

- In 2018, Chinese foreign direct investment into the U.S. fell to just $4.8 billion — a massive decline from $29 billion in 2017 and $46 billion in 2016, according to independent researcher the Rhodium Group.

- Including divestitures, Chinese net U.S. direct investment declined $8 billion in 2018, according to the group.

- Yet as direct investment dramatically falls, venture capital funding from Chinese sources into the U.S. hit a new record high of $3.1 billion, Rhodium said.

Chinese foreign direct investment into the U.S. plummeted for a second year in a row, according to new data.

In 2018, Chinese FDI in the United States fell to just $4.8 billion — a massive decline from $29 billion in 2017 and $46 billion in 2016, according to independent researcher the Rhodium Group.

The 2018 figure marks a 90 percent drop from 2016 and represents the lowest level of direct investment by China since 2011, according to the group's data.

The decline comes amid trade tensions between the U.S. and China and as Beijing adds pressure on Chinese companies to reduce their global holdings and reduce debt levels.

According to the data, a whopping $13 billion worth of U.S. assets were sold by Chinese investors, much of which was purchased during a 2015-2016 investment boom. Including those divestitures, Chinese net U.S. direct investment saw an $8 billion decline in 2018, according to Rhodium Group.

In fact, the group said there's another $20 billion in divestitures that's still pending.

In recent months, China's biggest private companies have put assets up for sale: Anbang has put up a number of its U.S. luxury hotels for sale, HNA Group has listed billions of dollars worth of assets for sale, Fosun International is looking to sell a stake in its New York property, 28 Liberty, and Dalian Wanda Group is exploring a sale of its stake in Legendary Entertainment.

Yet as direct investment dramatically falls, venture capital funding from Chinese sources into the U.S. hit a new record high of $3.1 billion, Rhodium said.

Meanwhile, Chinese investors continue to be the top foreign buyers in terms of both units and dollar volume of U.S. residential housing, for the past six years, according to the National Association of Realtors. That comes amid sustained interest in the American market from middle-class Chinese citizens.

Ref:https://www.cnbc.com/2019/01/15/chinese-foreign-direct-investment-to-the-us-falls-in-2018-data.html

China to relax boundaries further for outbound investment

China has just laid the groundwork for potentially even greater Chinese investment overseas, as news of the Chinese government’s latest decision to further loosen capital controls went viral.

Following previous policy relaxations, including unprecedented overseas investment reforms by the NDRC, China has unleashed yet another strategic move to globalise the yuan and bolster China’s bid to officially make it into the IMF basket of reserve currencies (SDRs).1

Last Friday, Assistant Minister of Commerce Zhang Xiangchen announced that China will soon allow companies and individuals to seek direct investments abroad soon via the QDII2 plan.2

What is QDII2?

Once officially passed, the QDII2 (Qualified Domestic Individual Investor Programme) will allow direct investment, acquisitions, and mergers overseas for both eligible and approved corporates and individuals.3

This includes real estate, stocks, bonds, mutual funds, insurance, and financial derivatives.3

Expected to kick off in six cities – Shanghai, Shenzhen, Tianjin, Wuhan, Chongqing, and Wenzhou4 – the QDII2 would be open for application to eligible individual investors bearing financial assets worth at least RMB1 million. However, qualified individuals will only be able to invest up to half of their total assets abroad.

Meanwhile, corporate investors would see their investment limits increased from their current limit of $300 million to $1 billion.

Nevertheless, it is expected that the Chinese government will be taking baby steps and proceed with QDII2 very carefully – even as they edge one step closer to attaining their objective of becoming the fifth reserve currency in the world.

What does this mean for the world?

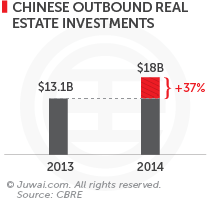

Previously, we wrote about how China’s shrewd move powered a global outbound investment boom, charting a record $102.9 billion last year – of which $18 billion came from real estate investment overseas alone.

Within the first four months of 2015, China’s outbound non-financial direct investment (ODI) hit $34.97 billion – a healthy 36.1% increase that bodes well for the remaining eight months to come.5

Hang on, though…it gets even better.

According to China’s Ministry of Commerce, Europe is hot with Chinese – Chinese ODI into the European Union skyrocketed 487%, while Chinese ODI in Germany spiked by as much as 246% y-o-y within Q1 of 2015.6

And this is all BEFORE this latest stunner from China.

We leave you to put your imagination to good use on visualising how this latest development from China would significantly impact and shape the global economy – especially in the roaring property industry that has already been propelled to new heights by Chinese money.

Ref:https://list.juwai.com/news/2015/06/china-to-relax-boundaries-further-for-outbound-investment

China easing on outbound investment policies

With China ramping up its offshore investments, countries worldwide are rejoicing.

And as China continues its push for global outbound investment diversification via policy liberalisations, they have even more reasons to cheer.

So far, one of China’s biggest changes was last year’s overseas investment reforms by China’s National Development and Reform Commission (NDRC) for Chinese corporations.

Under these new policies, Chinese investment projects abroad now no longer need approval from the ministry, except for projects in industries and countries that are considered sensitive by China's central government.

In real estate alone, property investments abroad by Chinese companies leapt 37% to a chart-topping $18 billion2 – including such investments like Ping An Insurance's acquisition of the Tower Place in London, and the sudden surge of commercial property investments in Sydney by Chinese developer megacorps.

With the burgeoning numbers of outbound Chinese travellers, hotel luxury and commercial investments by Chinese conglomerates are predicted to escalate this year too.

Click here for more iconic building and hotel deals snapped up around the world by Chinese investors.

What next, China?

According to Yi Gang, Deputy Governor of the People’s Bank of China and also Director of China’s State Administration of Foreign Exchange, China is studying regulatory amendments to relax limits on outbound investments for Chinese individuals too.3

The China Central Government has not formally announced any plans to change existing rules, but investors worldwide are abuzz about the prospect of such an easing, as it could potentially mean $1 million – $2 million worth of international capital outflow for Chinese individuals.2

Currently, Chinese citizens are allowed to invest overseas via funds licensed under the Qualified Domestic Institutional Investor programme, as well as exchange the equivalent of $50,000 a year into foreign currency.4

Potential global impact and payoff

If approved, this new ruling would not only allow greater access to international markets for Chinese individuals, but it would also further increase property investments abroad by Chinese individuals and remove demand from domestic housing market.4

A Barclays report last November predicts that almost half of China’s millionaires are on the hunt for property investment opportunities overseas within the next 5 years.7

Already, the Shanghai Free Trade Zone – a testing ground for economic policies – reported that a trial programme might start this year to allow Chinese individuals exchange an annual limit of over $50,000 for investments abroad.5

Upon sanction, this groundbreaking programme could effectively eliminate a major regulatory hitch presently hindering rich Chinese from investing more in international property and other assets.

Judging from these new developments – which dovetail nicely with China's mutual 10-year visa agreements recently struck between Canada and the US – we only have one piece of advice for real estate agents and developers worldwide:

Get ready, because a deluge of Chinese outbound investments may be just around the corner!

Ref:https://list.juwai.com/news/2015/04/china-easing-on-outbound-investment-policies

No comments:

Post a Comment