WHAT ARE CRYPTOCURRENCIES?

(and why is everybody talking about them)?

Worthless. Or, rather more commonly, the government loads up on excessive debt, or fails to regulate the massive bets that financial institutions make to generate profits, and the system teeters on the brink of collapse, as was the case during the Great Recession of 2008.

This risk is what underpins the arguments in support of precious metals and the creators and users of cryptocurrencies. Trading Opportunity If central banks can create money from thin air, why can’t anyone else?

Cryptocurrencies have no central authority, they’re not tied to countries and they don’t carry any liability or counterparty risk.

They do not require banks as intermediaries, so there are no exchange rates, bank fees or other variables that drain value, as when fiat money moves between accounts.

The platforms that hold your Bitcoins do not use them while they sit in your account to generate profits for themselves (and risk for you), as banks do. When you transfer a cryptocurrency, the platform will not hold onto it for three days after removing it from your account (even though it can be transferred in an instant), make money from it — and then charge you for the privilege. Neither do account-holders have to undergo a lengthy application or verification process. The systems are anonymous. There is, of course, a flipside.

In many respects, there is no difference between the Singapore dollars you hold in your bank account and a Bitcoin you hold in an electronic wallet. Both carry a value that can be exchanged for goods and services, and that value changes as perceptions fluctuate.

The difference is that the fluctuations of the Singapore dollar are kept in check by the authority that backs them. Because Bitcoin and Ethereum are not backed by a central authority or subject to any recognized macroeconomic or geopolitical forces, prices are

They present a risk to owners, because nobody wants to hold their savings in a currency that can lose a quarter of its value overnight. However, that does mean cryptocurrencies present an opening for derivatives traders, for whom volatility equals opportunity. "Will cryptocurrencies present an opening for derivatives traders, for whom volatility equals opportunity?"

Copyright: © All Rights Reserved

Download as PDF, TXT or read online from ScribdUNDERSTANDING CRYPTOCURRENCIES AN INTRODUCTION FOR TOMORROW'S INVESTORS!

IG Bloomberg Cryptoebook by Than Han on Scribd

....

What is Cryptocurrency Trading?

The smart alternative of forex trading

Cryptocurrency Trading Overview

Cryptocurrency Trading is the Forex (Foreign Exchange) of cryptocurrencies. This means, you are able to trade different bitcoin and altcoin normally for USD and BTC. Cryptocurrency Trading is an alternative way to get involved in the Crypto-World! It doesn’t require mining hardware nor investing in bitcoin hyips or bitcoin cloud mining (which always has risk involved in their integrity).

Why trade bitcoin and not Forex?

Easy to enter

To start trading bitcoin and earning money, you really need less than an hour – for the how to steps, just scroll down. If you want to start trading Forex, you need to open an account – this takes several weeks until they send you the sign up forms and access code. Then it takes some days until you transfer some money from your bank account to your Forex Broker.We should not forget, that crypto-trading is also easy to leave. You just transfer your bitcoins out of the exchange into your wallet and you are done. We don’t even want to start talking about how nerve-racking it is to quit your broker.

Smaller Spreads

One huge advantage over Forex are the low spreads. The spread is the difference between the ask and bid price of the market maker.Spread Example: Let us analyse the spread of EUR/USD. The ask and bid are 1.0933 and 1.0931 respectively (data from 27.02.2016). The spread is 0.0002. Percent-wise, this is a spread of 0.0002/1.0933 = 0.018%

Now let us see the spread in bitcoin to USD. The ask price for 1 BTC is 429 USD, while the bid price is 428.999 USD (data from 27.02.2016). This equals to a spread of 0.001 USD or 0.001/429 = 0.0002%.

A smaller spread means, that when you exchange, you have made nearly no loss. On the contrary in Forex (btw. other than eur/usd have even higher spreads) after you exchange, you have already made a loss of 0.018%. Which is not insignificant.

Never the less, don’t forget to check your transaction fees at your exchange.

Margin at Cryptoexchanges

The features of leverage and margin trading is possible on some Forex as well as on Cryptocurrency Exchanges.Margin Trading: You are allowed to use funding from peer-to-peer margin funding providers. This means, that you can borrow buying/selling power, but you need to alocate some funds (=margin) which won’t be accecible until you return the lending capital.

For example, you only have 429 USD but you want to buy 2 BTC. This is possible, but you will have to pay some interest after you close your position. For example, the BTC close at 450. So you have made 2*21 USD = 42$ winnings. Than you only need to subtract the low interest (about 2%) and you have your final earnings, which are higher, if you predicted the course of the trade correctly. Though you can lose more, when you have a losing position.

Leverage at Cryptoexchanges

You have the option to use leverage trading on some Forex and Cryptocurrency Exchanges.Leverage Trading is the possibility to trade an amount, which you don’t have at your disposal. Normaly Cryptocurrency Exchanges offer a leverage of 1:10. This means, that for each dollar you get 10 dollars of buying power.

In conclusio this means a higher risk and a possible higher profit.

Getting started trading cryptocurrencies like Bitcoin

The first thing you need is a wallet. Only then you are able to buy crypto-currencies like bitcoin or ethereum and protect them. We have made a guide on how to obtain bitcoin already, check it out if you don’t already posses one.The majority of cryptocurrency exchanges have a free a wallet along the ability to trade, but we suggest, that you don’t put all your bitcoin at one place. This way you can minimize your risk of an exchange getting broke (f.e. MT GOX), being scammed or getting hacked.

Security: Don’t forget to activate your two-factor-authentication to be more safe. Most exchanges offer cryptocurrency trading with the need of bitcoin (for example: ethereum for bitcoin, or bitcoin for litecoin), this is why bitcoin is the first thing you should consider buying.

Cryptocurrency Exchanges

Now after you bought yourself some bitcoin, the time has come to choose your exchange place. This is where you are able to instantly trade from one cryptocurrency into a different one. Take note of the currency trading pairs – each exchange has a list of their own. There are exchanges, where you are able to only exchange Bitcoin to Altcoin, but not Altcoin to any other Altcoin. This hinders the ability to trade fast and flexible. That is why we have made a list of the best crypto-exchanges. On this list you can find the most competitive bitcoin brokers available, offering lowest transaction fees.After opening an exchange account, you need to transfer an amount of bitcoin from your wallet to your exchange account. Another option is to deposit fiat currencies (like USD, EUR etc.) – but take into consideration the fact that there are higher fees attached to those transactions.

Check out one of the biggest Bitcoin CFDs here.

Cryptocurrency CFDs (Contact for Difference)

Bitcoin and Ethereum CFDs offer a possibility to trade on the cryptocurrency market without the need of owning any coins at all.A crypto CFD is a contract between the buyer and seller, where typically the seller will pay to the buyer the difference between the current value of the crypto asset and its value at end of the contract. CFD certificates are typically used on goods (derivates) that are hard to store/own like gold, oil barrels and in this case cryptos.

There are pros and cons of using CFDs to trade cryptocurrencies:

Pros and Cons on trading crypto assets over CFDs

The two benefits of using CFDs to trade cryptocurrencies are:- Trust – Most CFD platforms have been established for many, many years. They are also highly regulated by the governments, which leads to a high level of security in comparison to cryptocurrency exchanges.

- Simplicity – Usually you can trade with fiat currency and you also don’t need to find yourself a wallet.

- Higher Fees – The fees can go up to 5% in comparison to 0.5% of normal cryptocurrency exchanges. Also, it is important to note, that many CFD platforms state that they have 0% fees, yet the spread between the buy and sell price of the crypto certificate is quite big.

- Less privacy – You will be asked for more personal information in comparison to normal crypto exchanges.

Automated Bitcoin bot trading

The human mind can only follow several indicators at a given time. A Bitcoin (or other crypto-currency) bot can follow and try all the indicators at any time on all the cryptocoins. A Bitcoin bot doesn’t need sleep – a bot can be active at any time you wish, this allows to have a better sound, because you can be sure, that the bot will trade if something crucial happens.Bitcoin Bots are accessible

Financial bots have existed for many years, but they were only accessible to the brokers and banks. Just the Bloomberg API cost 10000$ per year. Bitcoin Bots are different. They are managed on an external cloud/server, which means you don’t need to have your computer running all the time. The strategies are pseudo-coded – so you can say for example, if this indicator crosses that indicator, then buy. Else wait for that indicator. Most bots are user made with different ratings, which allow you to choose easily from several strategies, without the need to program any code at all. For example Cryptotrader.org – this way you can follow one of the profitable trading bots. Check out our CryptoTrader Review & day to day test to see if this is something for you, or not!

Trade the rumor – sell the news

This is an old saying in the stock-trading scene, which also should be followed in the cryptocurrency-trading-world! We are going to post our latest trades, suggestions and technical analysis on our Bitcoin news blog, but you should not limit yourself only to us. Other sources are twitter hashtags for the crypto-coin and crypto-forums like reddit for example.There is lot’s of value created by ‘pump- & dumpers’ so watch out! Always set a goal, which you want to achieve, for example 25%. If you don’t check you exchanges daily, then the best thing you could probably do is add a limit order. A limit order is executed, when a limit price is reached. For example, if you buy a dogecoin for 0.05 BTC. You can make a limit order for 0.075 BTC. This means, when the dogecoin gets a value higher than 0.075 BTC, your order will instantly be executed. This makes sure, that you don’t pass out on the moment – it can always fall back to 0.05 before you can see the trade opportunity.

Golden cryptocurrency trading rules

Here is our list of most important trading rules, which we recommend you to follow:- Hold NOTHING long term except BTC. (>2 weeks is dangerous).

- Never buy into a coin after a dump.

- Learn to understand the bitcoin (or any) chain.

- Learn to understand the correlation between bitcoin and an altcoin.

- Learn to understand candle stick charts. They offer significant information, which can’t be figured out of normal lined charts.

- Secure winning & limit losses

- Learn technical analysis. This plays a major role in the market movement.

- Don’t trade if you have sleep problems because of a single trade. That is just not worth it.

Please help us make the list even bigger. You can always easily contact us over here.

Storing Bitcoins on Cryptoexchanges

Important notice for Bitcoin newcommers: Like stated above, hacks on crypcurrency exchanges do happen. This is why, if you just trade occasionally there are two things you can and should do:- Store your cryptocurrencies at your cold bitcoin hardware wallet – so your coins are 100% secure, or

- If you want to maximize the return of the coins you currently have, then you should read our article on bitcoin lending on exchanges

Summary on cryptotrading

We see the cryptotrading as a good opportunity to make good money. Many coins quadruple their value in less than a week. Though you always need to be cautious, because there are lots of fake coins, pump & dumps, schemes and ponzis.Follow our (and your own) rules and you will be able to take advantage over the people who don’t. Also, you will be able to detect which crypto-coins are scams and which have potential to skyrocket like bitcoin. This shall be a journey, which we will take with you, where we will try to find the safest and most promising opportunities on the crypto-market!

As a conclusion you need to be careful where you invest – and don’t forget: never invest, what you can’t afford to lose.

Useful Bitcoin Trading Links and Information

After reading all this bitcoin (altcoin) cryptocurrency trading text here some things, which might interest you as well:- Lending Bitcoin on Exchanges – make easy returns.

- List of the Cryptocurrency Exchanges we use (in work)

Important Notice:

Hello, we have cleaned up the comment section, since many of you just wrote “please teach me how to trade like a master”.

We have decided to further develop the content this website is

offering, and increase our time spending on guides! But. But we need you

to clearly define what you want to learn/see from us.

For example, if you are interested into having a test-trading account,

then say this, and not something too general in terms of cryptocurrency

trading.

Also, we have made a new option to “thumbs up/down” a comment. This way we can use this chat as a better communicational channel! So to summarize it:

Ref:https://www.coinstaker.com/cryptocurrency-trading/:

As

traders, our job is to take advantage of opportunities in the markets.

Sometimes, these opportunities come in the form of entirely new markets.

As

traders, our job is to take advantage of opportunities in the markets.

Sometimes, these opportunities come in the form of entirely new markets.

I've been interested in cryptocurrencies for a few years now, but I've been very reluctant to trade them, much less write about trading them. I felt that there was just too much risk.

Especially for the average trader.

…and quite frankly, I didn't understand them well enough myself.

The first time that I saw them as viable for trading was when I went to this conference. I saw Chris Dunn talk about trading Bitcoin, but I was still skeptical that it would stay around for the long-term.

…until recently.

I credit my friend for talking to me about it on Twitter and opening my eyes to the potential in trading this emerging market. I'm not sure if he wants to be named, but you know who you are. I sincerely appreciate the education and helping me see the light!

This is a perfect example of the benefit of staying in touch with other traders on platforms like Twitter.

Anyway, as I have done more research and have actually started trading them, I have found that there are tremendous opportunties. With some coins, it's potentially like being able to get pre-IPO shares of Microsoft.

But there are also big risks.

Remember, the dot-com bust?

There will probably be losses of that magnitude too. That's just how these new technologies work.

So in this post, I want to share with you my knowledge of the cryptocurrency markets and give you a total beginner's guide to trading them. Be sure to bookmark this page because I'll continually update the information, as things change.

For you crypto veterans, this will be very simplified, but my goal is to make this information as easy to understand as possible so new traders can make an informed decision about the opportunities. Once people get the general concepts, then they can geek out about the details.

This is the future of FX trading. So in addition to USD/CHF, CAD/JPY and EUR/GBP, we also need to be aware of XLM/USD, ETH/BTC and XRP/LTC…

Let's start at the beginning.

You may have heard many things about what a cryptocurrency is, but you may still be searching for an understandable definition. I hear ya, I was in the same boat for a long time.

Instead of getting to technical, here's the easiest way to think about cryptocurrencies:

Examining how these platforms work will help you understand cryptocurrencies.

Here are a few software platforms that many people use:

More on blockchain technology in the next section of this guide.

But wait, what are the software services that you are getting? Isn't a cryptocurrency like Bitcoin just a currency, like US Dollars?

Not quite.

The goal of cryptocurrencies is usually to improve on some type of existing software system or network. When you send money via PayPal, Fedwire or Western Union, you are basically sending fiat money electronically, similar to Bitcoin.

However, that's where the similarity ends.

Platforms like PayPal have severe limitations on what you can and cannot do. For example, you cannot send/receive money from certain countries (like Nigeria).

Cryptocurrencies like Bitcoin want to make financial transactions more open and accessible to everyone around the world.

Other cryptocurrencies solve other problems, which we will explore later in this guide.

Since this is a new concept to most people, it will take some time to become widely accepted. This is where Bitcoin has been instrumental in paving the way for this new technology.

Websites like Newegg take Bitcoin, along with the other traditional payment methods. Here's what the checkout screen looked like after I added a drone to my cart.

Payment processor Stripe also allows online merchants to accept Bitcoin.

Notice that other coins like Ether or Litecoin are not accepted. However, the fact that Bitcoin is accepted, is a big step towards the adoption of other cryptocurrencies.

…and they will fail spectacularly.

Right now, there is a lot of buzz around certain cryptocurrencies increasing several thousand percent, in a few months. This has a lot to do with ignorance and hype.

Just like when people found out that this new thing called the “internet” would change the world of business.

Did it change the world?

Of course.

But was there a lot of dumb money that overhyped the first wave of internet companies?

Totally.

So just remember, trading cryptocurrencies is kind of like trading a software stock. Some of the software will change the world.

Others will explode in a giant ball of fire.

There are also a lot of scam coins out there, so be careful. Like penny stocks that are just a company on paper, almost anyone can create a new cryptocurrency.

Learn how to separate the scams from the deeply underpriced currencies. Then use proper risk management and play the odds.

Let's face it, cryptocurrencies were created by super nerds. Like with Linux, there is still quite a bit of technical know-how that is required.

You don't need to know how to code, but if you are “not good with computers” you may want to stay away from cryptocurrency trading, at least until they start building more user friendly interfaces.

Don't get me wrong, I'm not calling anyone dumb. I'm just saying that if you don't possess a certain skillset, then you shouldn't get involved in that area. This could cause you to lose a lot of money, very quickly.

For example, I don't know how to sew, so I don't make my own clothes. If I did try to make my own clothes, everyone who meets me would think I'm a weirdo for wearing fucked up pants.

You get the picture.

So if you aren't so tech savvy, but still want to get involved, find someone you trust to trade for you.

However, I would still trust the bigger cryptocurrency exchanges over a lot of offshore binary options brokers 🙂

So the lesson is: Don't keep too much of your coinage at the brokers. Move them off to your own wallet as soon as possible.

I'll get to wallets later in this guide.

Simply put, a blockchain is a database.

However, there is one huge difference between how you probably currently think of a database and how a blockchain database works.

In most cases, a traditional database sits on one computer or in one location.

Even if a company has redundant servers around the world, the data might only be backed up between 3 to 5 locations. On top of that, these companies collectively spend billions of dollars a year on cyber security, to protect this data.

With a blockchain database, the data can be backed up on potentially thousands of computers all over the world, for a much, much lower cost. The information in these databases is heavily encrypted and sometimes files are broken up into pieces, so even if one piece is exposed, it will not expose the entire file.

If the information on one server does become compromised by hackers, the other copies of the databases have to “agree” that the compromised data was a legitimate change to the data. If the other copies do not agree, then the change is rejected and it is changed back to match the others.

Obviously, this is an oversimplified explanation of the technology, but I hope that you are starting to see the benefits.

Instead of just one point of failure, like on a single server, you now have multiple copies of the same database all over the world that is almost impossible to crack and will “fix” itself in the case of a hack. This can also save a ton of money on cyber security software and services.

Example

Let's say that a hacker gets into your bank's computer tomorrow and transfers all of your money to his account, then deletes any trace of the transaction. With today's technology, you would probably be screwed.

But with a blockchain currency like Bitcoin, if one server was hacked and a fake transaction was inserted into the database, then it wouldn't match the transaction record on the hundreds other copies of the database. This transaction would be seen as a fake and rejected.

Your money would be safe.

This is one of the many reasons why blockchain technology is so exciting.

This understanding will also allow you to assess the long-term viability of these different currencies and which ones will be more desirable in the future.

Example

Tether is a cryptocurrency that wants to be the proxy for fiat currencies. So there is a Tether USD version, EUR version, etc. But each one is pegged to the value of the currency, so you can never make any money trading it.

It is purely to provide stable and liquid transactions. So one USD Tether will always be worth about $1.

If you didn't know this and bought a bunch of it, thinking that it's cheap compared to Bitcoin, you will tie up your money in an asset that will never appreciate. Sure, you won't lose money either, but you would have lost out on other opportunties.

So understand the nuances of each crypto, it's very important.

It's like Windows vs Mac.

…or iOS vs Android.

Here are a few examples of the different types of cryptocurrencies and what they are designed to do. This is not an exhaustive list, just a sample.

Note: I don't necessarily support these currencies, I'm just using them as examples of the different use case niches within cryptocurrencies.

But with digital currencies, there are a few wrinkles that you need to get your head around, but the idea is similar. Let's take a look at how cryptocurrency storage works.

You store your cryptocurrencies on the blockchain in a “wallet.” This is simply an address on the blockchain. It's like how the website address tradingheroes.com directs you to my website, on the internet.

Each wallet has a public address and a private address. The public address is the address that people send funds to. The private address is the “password” that you use to access and send your funds.

Never expose your private key until you are ready to spend your funds, otherwise you will probably lose all the money in your wallet.

Here's an example from a Bitcoin paper wallet:

Now that you understand the basics of cryptocurrency wallets, let's

look at the different wallet options out there. Here are the different

ways that you can store your loot:

Each exchange has it's own nuances and rules, so be sure you understand them before trading any significant amount of money. For example, you don't even have to setup an account at ShapeShift. It feels weird in the beginning, but after the first transaction, it makes total sense.

Here is what you need to be aware of when you trade cryptocurrencies.

Of course, there is no guarantee that these things will move the market. But based on what we have seen so far,

When Coinbase added Litecoin to their already limited list of cryptocurrencies that can be bought, they made it easily accessible to the average person.

Their interface is the best I've seen so far. It makes it so easy for the non-technical person to buy Litecoin.

Soon after the Coinbase launch (marked with the arrow, in the chart below), the price of Litecoin started to skyrocket and it has never looked back.

Now, you might be thinking that this could simply be a coincidence.

…and it could.

But it is very, very likely that exposing Litecoin to Coinbase's user base helped boost the price.

So when a large exchange announces that they will start listing a cryptocurrency that you are trading, take notice.

Watch exchanges like Coinbase, Bitfinex, Poloniex or CEX.

It could give it the boost you have been looking for.

If you have ever funded your trading account with Bitcoin or tried to buy anything with Bitcoin, you will understand what I mean. For a digital currency, the transaction time is a little slow.

It can take about 30 minutes or more, to do a single transaction.

Upgrading this speed has been hotly debated and finally led to the creation of Bitcoin Cash. After the split of Bitcoin Cash, Bitcoin has taken off to new highs.

There will be countless other software changes across all cryptocurrencies, so make sure that you understand the implications of those changes.

Good or bad.

So before you dismiss something as just hype, remember that hype moves markets too. But if you do trade hype, be sure to close your trade out long before the hype has a chance to cool off.

Otherwise, it could be a very expensive lesson.

This is where storage becomes an important part of the cryptocurrency valuation equation.

Unlike traditional fiat currency that can be stored in a bank, your trading account, or your mattress at home, cryptocurrencies need to have a compatible wallet (or cold storage solution) to be stored safely.

Remember that cryptocurrency is simply software. So the wallet software needs to be able to work with the cryptocurrency software.

It's like trying to use the Windows version of Microsoft Office on a Mac.

That simply won't work.

Therefore, if a cryptocurrency doesn't have a good wallet yet, that will prevent less technical investors from buying the currency.

But as soon as one is available, then it makes the currency much more accessible to the masses.

…and thus, more valuable.

If you find that a cryptocurrency does not have a good wallet solution yet, that could be one signal that it is undervalued.

Looking for opportunities to buy, immediately after the launch of the first high-quality wallet, could give you a nice short-term profit.

If one of these DApps or Decentralized Apps does very well, this can have a positive effect on the underlying platform currency.

The value of the tokens should theoretically be independent of the value of the platform.

However, not everyone understands this and the success of one DApp can drive the price of Ether…at least in the short term.

So if you are trading a platform cryptocurrency, watch promising apps on the platform closely.

One example is in Venezuela, where the police have been arresting Bitcoin miners on made-up charges. This has forced miners to go underground or start mining Ether instead.

But this could happen in any country. Any decision by the NFA or SEC could affect the value of certain cryptocurrencies. The SEC has already banned certain Initial Coin Offerings (ICOs), due to the potential pump and dump situation that could happen with those coins.

Be aware of current trends in government regulation and steer clear of currencies that could get red flagged by government agencies.

There will be more detailed posts on specific currencies and how to do some of the things mentioned above.

If you have any more questions or comments, leave them below.

Happy Trading!

Disclaimer: Some links on this page are affiliate links. We do make a commission if you purchase through these links, but it does not cost you anything extra and we only promote products and services that we personally use and wholeheartedly believe in. A portion of the proceeds are donated to my charity partner.

Also, we have made a new option to “thumbs up/down” a comment. This way we can use this chat as a better communicational channel! So to summarize it:

Ask us precize questions! If a specific comment has a good number of ‘likes’, then we will make a in details guide trying to answer it!Thanks for your understanding, Philip from Team CoinStaker.

Ref:https://www.coinstaker.com/cryptocurrency-trading/:

The Total Beginner’s Guide to Cryptocurrency Trading (Bitcoin, Ether and More)

As

traders, our job is to take advantage of opportunities in the markets.

Sometimes, these opportunities come in the form of entirely new markets.

As

traders, our job is to take advantage of opportunities in the markets.

Sometimes, these opportunities come in the form of entirely new markets.I've been interested in cryptocurrencies for a few years now, but I've been very reluctant to trade them, much less write about trading them. I felt that there was just too much risk.

Especially for the average trader.

…and quite frankly, I didn't understand them well enough myself.

The first time that I saw them as viable for trading was when I went to this conference. I saw Chris Dunn talk about trading Bitcoin, but I was still skeptical that it would stay around for the long-term.

…until recently.

I credit my friend for talking to me about it on Twitter and opening my eyes to the potential in trading this emerging market. I'm not sure if he wants to be named, but you know who you are. I sincerely appreciate the education and helping me see the light!

This is a perfect example of the benefit of staying in touch with other traders on platforms like Twitter.

Anyway, as I have done more research and have actually started trading them, I have found that there are tremendous opportunties. With some coins, it's potentially like being able to get pre-IPO shares of Microsoft.

But there are also big risks.

Remember, the dot-com bust?

There will probably be losses of that magnitude too. That's just how these new technologies work.

So in this post, I want to share with you my knowledge of the cryptocurrency markets and give you a total beginner's guide to trading them. Be sure to bookmark this page because I'll continually update the information, as things change.

For you crypto veterans, this will be very simplified, but my goal is to make this information as easy to understand as possible so new traders can make an informed decision about the opportunities. Once people get the general concepts, then they can geek out about the details.

This is the future of FX trading. So in addition to USD/CHF, CAD/JPY and EUR/GBP, we also need to be aware of XLM/USD, ETH/BTC and XRP/LTC…

Table Of Contents

What is a Cryptocurrency?

Let's start at the beginning.

You may have heard many things about what a cryptocurrency is, but you may still be searching for an understandable definition. I hear ya, I was in the same boat for a long time.

Instead of getting to technical, here's the easiest way to think about cryptocurrencies:

A cryptocurrency is basically money on software platforms.It's important to keep in mind that the teams/companies that are behind these cryptocurrencies are not only creating a new form of currency, but a new software platform. To demonstrate how this works, let's take a look at other software platforms that you are probably already familiar with.

Examining how these platforms work will help you understand cryptocurrencies.

Here are a few software platforms that many people use:

- Windows: A software platform for personal computers

- Dropbox: A software platform for storing and sharing documents

- Fedwire: A software platform that sends money between financial institutions

- Windows: You pay US Dollars (or your local fiat currency) to buy a license for Windows to use on your computer. If you buy a computer that already has Windows on it, the license fee is included in the purchase price.

- Dropbox: You pay US Dollars (or your local fiat currency) to buy a subscription to use the software for a month or a year, depending on which plan you buy.

- Fedwire: You pay a transaction fee to use the system and you send fiat currency itself.

- Windows: Database is stored on your local computer

- Dropbox: Database is stored on the Dropbox servers

- Fedwire: Database is stored on the Fedwire servers

More on blockchain technology in the next section of this guide.

But wait, what are the software services that you are getting? Isn't a cryptocurrency like Bitcoin just a currency, like US Dollars?

Not quite.

The goal of cryptocurrencies is usually to improve on some type of existing software system or network. When you send money via PayPal, Fedwire or Western Union, you are basically sending fiat money electronically, similar to Bitcoin.

However, that's where the similarity ends.

Platforms like PayPal have severe limitations on what you can and cannot do. For example, you cannot send/receive money from certain countries (like Nigeria).

Cryptocurrencies like Bitcoin want to make financial transactions more open and accessible to everyone around the world.

Other cryptocurrencies solve other problems, which we will explore later in this guide.

Is Cryptocurrency Real Money?

Yes.Since this is a new concept to most people, it will take some time to become widely accepted. This is where Bitcoin has been instrumental in paving the way for this new technology.

Websites like Newegg take Bitcoin, along with the other traditional payment methods. Here's what the checkout screen looked like after I added a drone to my cart.

Payment processor Stripe also allows online merchants to accept Bitcoin.

Notice that other coins like Ether or Litecoin are not accepted. However, the fact that Bitcoin is accepted, is a big step towards the adoption of other cryptocurrencies.

Risks of Cryptocurrency Trading/Investing

Now that you understand the basics, what are the risks of trading these cryptocurrencies? There are quite a few, but here are the top three.1. Some Technologies Will Fail

Remember that cryptocurrencies are basically software, created by people or companies. So just like Webvan or Pets.com in the dot-com bust, some of these technologies will fail.…and they will fail spectacularly.

Right now, there is a lot of buzz around certain cryptocurrencies increasing several thousand percent, in a few months. This has a lot to do with ignorance and hype.

Just like when people found out that this new thing called the “internet” would change the world of business.

Did it change the world?

Of course.

But was there a lot of dumb money that overhyped the first wave of internet companies?

Totally.

So just remember, trading cryptocurrencies is kind of like trading a software stock. Some of the software will change the world.

Others will explode in a giant ball of fire.

There are also a lot of scam coins out there, so be careful. Like penny stocks that are just a company on paper, almost anyone can create a new cryptocurrency.

Learn how to separate the scams from the deeply underpriced currencies. Then use proper risk management and play the odds.

2. It Requires Technical Savvy

Let's face it, cryptocurrencies were created by super nerds. Like with Linux, there is still quite a bit of technical know-how that is required.

You don't need to know how to code, but if you are “not good with computers” you may want to stay away from cryptocurrency trading, at least until they start building more user friendly interfaces.

Don't get me wrong, I'm not calling anyone dumb. I'm just saying that if you don't possess a certain skillset, then you shouldn't get involved in that area. This could cause you to lose a lot of money, very quickly.

For example, I don't know how to sew, so I don't make my own clothes. If I did try to make my own clothes, everyone who meets me would think I'm a weirdo for wearing fucked up pants.

You get the picture.

So if you aren't so tech savvy, but still want to get involved, find someone you trust to trade for you.

3. There's a Lot of Broker and Technology Risk

Since this is emerging technology, there are still a lot of unknowns with trading at scale and how brokers and the software will react to certain surprise events. If you think that Forex brokers are risky, then you should consider cryptocurrency brokers at least twice as risky. Not just because they could be shady, but there a still so many unknowns with the technology.However, I would still trust the bigger cryptocurrency exchanges over a lot of offshore binary options brokers 🙂

So the lesson is: Don't keep too much of your coinage at the brokers. Move them off to your own wallet as soon as possible.

I'll get to wallets later in this guide.

What is a Blockchain?

Simply put, a blockchain is a database.

However, there is one huge difference between how you probably currently think of a database and how a blockchain database works.

In most cases, a traditional database sits on one computer or in one location.

Even if a company has redundant servers around the world, the data might only be backed up between 3 to 5 locations. On top of that, these companies collectively spend billions of dollars a year on cyber security, to protect this data.

With a blockchain database, the data can be backed up on potentially thousands of computers all over the world, for a much, much lower cost. The information in these databases is heavily encrypted and sometimes files are broken up into pieces, so even if one piece is exposed, it will not expose the entire file.

If the information on one server does become compromised by hackers, the other copies of the databases have to “agree” that the compromised data was a legitimate change to the data. If the other copies do not agree, then the change is rejected and it is changed back to match the others.

Obviously, this is an oversimplified explanation of the technology, but I hope that you are starting to see the benefits.

Instead of just one point of failure, like on a single server, you now have multiple copies of the same database all over the world that is almost impossible to crack and will “fix” itself in the case of a hack. This can also save a ton of money on cyber security software and services.

Example

Let's say that a hacker gets into your bank's computer tomorrow and transfers all of your money to his account, then deletes any trace of the transaction. With today's technology, you would probably be screwed.

But with a blockchain currency like Bitcoin, if one server was hacked and a fake transaction was inserted into the database, then it wouldn't match the transaction record on the hundreds other copies of the database. This transaction would be seen as a fake and rejected.

Your money would be safe.

This is one of the many reasons why blockchain technology is so exciting.

The Characteristics of a Currency to be Aware of

Although cryptocurrencies are all based on blockchain technology, they are not all created equal. Here are some differences that you need to understand to make informed trading decisions:- Transaction processing speed

- Total supply currently available

- Will there ultimately be a limit on the total number of currency available?

- Will there be an unlimited supply of currency?

- Is there a real-world need for this software/currency?

- Real world adoption of the technology

- Any big investors in the project?

- Does the use of the software make sense?

- Do the founders have a reputable background?

This understanding will also allow you to assess the long-term viability of these different currencies and which ones will be more desirable in the future.

Example

Tether is a cryptocurrency that wants to be the proxy for fiat currencies. So there is a Tether USD version, EUR version, etc. But each one is pegged to the value of the currency, so you can never make any money trading it.

It is purely to provide stable and liquid transactions. So one USD Tether will always be worth about $1.

If you didn't know this and bought a bunch of it, thinking that it's cheap compared to Bitcoin, you will tie up your money in an asset that will never appreciate. Sure, you won't lose money either, but you would have lost out on other opportunties.

So understand the nuances of each crypto, it's very important.

What are the Different Cryptocurrency Use Cases?

Almost every currency software has a different intended purpose and individual implementation, with inherent strengths and weaknesses.It's like Windows vs Mac.

…or iOS vs Android.

Here are a few examples of the different types of cryptocurrencies and what they are designed to do. This is not an exhaustive list, just a sample.

Note: I don't necessarily support these currencies, I'm just using them as examples of the different use case niches within cryptocurrencies.

Worldwide Financial Transactions

Application Platforms

Private Financial Transactions

Specialty Currencies

Take a look at these different use cases and figure out which ones make the most sense to you. Then understand how each software implementation works and think about what will probably do well in the future.How Do You Store Cryptocurrencies?

With fiat currency like US Dollars, you can store them at the bank or in your wallet. It's pretty straightforward.But with digital currencies, there are a few wrinkles that you need to get your head around, but the idea is similar. Let's take a look at how cryptocurrency storage works.

You store your cryptocurrencies on the blockchain in a “wallet.” This is simply an address on the blockchain. It's like how the website address tradingheroes.com directs you to my website, on the internet.

Each wallet has a public address and a private address. The public address is the address that people send funds to. The private address is the “password” that you use to access and send your funds.

Never expose your private key until you are ready to spend your funds, otherwise you will probably lose all the money in your wallet.

Here's an example from a Bitcoin paper wallet:

Image: bitcoinpaperwallet.com

- Online wallet: This is probably the easiest way to store your money. But it is also the least secure. So it's not a good long term storage solution, but it is fine for buying things and funding your trading accounts. Exchanges like Coinbase also have their own wallets built in.

- Mobile wallet: You can download a mobile app like Mycelium to store your spending money. It is more secure than an online wallet, but if your phone ever breaks or it gets hacked, everything in your wallet will be gone.

- Desktop wallet: Similar to a mobile app but just for desktop computers.

- Hardware device wallet: These are hardware devices that are built especially for storing cryptocurrency keys. They are safer than the options above, but they are still susceptible to the things that can damage all electronic devices.

- Paper wallet: You can also store your private key on paper, like in the picture above. This is the most hacker proof, but it is also the least convenient. If you are going to go this route, be sure to store them in a safe place (like a safety deposit box) and don't actually use paper. Use something like this to make sure that your money isn't lost to something as simple as a spilled beer.

Exchanges

Now we get to trading. Here are some of the exchanges that you can trade on.Each exchange has it's own nuances and rules, so be sure you understand them before trading any significant amount of money. For example, you don't even have to setup an account at ShapeShift. It feels weird in the beginning, but after the first transaction, it makes total sense.

Cryptocurrency Tracking Apps

Before I wrap it up, you will probably need an app to track cryptocurrency prices on your phone. So here are a couple of apps that might work for you.- Blockfolio: A simple app that allows you to add a watchlist and add trades so you can track your portfolio, ala stock trading apps. The most useful thing about this app is that it displays all currencies on your watchlist in the currency of your choice. Some apps insist on displaying the value in Bitcoin, which is annoying.

- Coincap: This app allows you to display currencies by market capitalization, volume and other ranking factors. They also have cool charts. Very useful for seeing what is being actively traded. Also displays prices in your currency of choice.

What Can Affect the Price of a Cryptocurrency?

There are many things that can affect the price of a cryptocurrency…sometimes very quickly.Here is what you need to be aware of when you trade cryptocurrencies.

Of course, there is no guarantee that these things will move the market. But based on what we have seen so far,

Exchange Listing

This is a big one.When Coinbase added Litecoin to their already limited list of cryptocurrencies that can be bought, they made it easily accessible to the average person.

Their interface is the best I've seen so far. It makes it so easy for the non-technical person to buy Litecoin.

Soon after the Coinbase launch (marked with the arrow, in the chart below), the price of Litecoin started to skyrocket and it has never looked back.

Now, you might be thinking that this could simply be a coincidence.

…and it could.

But it is very, very likely that exposing Litecoin to Coinbase's user base helped boost the price.

So when a large exchange announces that they will start listing a cryptocurrency that you are trading, take notice.

Watch exchanges like Coinbase, Bitfinex, Poloniex or CEX.

It could give it the boost you have been looking for.

Software Upgrades

Over the past few years, there has been a lot of discussion in the Bitcoin community about upgrading the core software functions of Bitcoin. The primary discussion has been around the transaction speed of Bitcoin.If you have ever funded your trading account with Bitcoin or tried to buy anything with Bitcoin, you will understand what I mean. For a digital currency, the transaction time is a little slow.

It can take about 30 minutes or more, to do a single transaction.

Upgrading this speed has been hotly debated and finally led to the creation of Bitcoin Cash. After the split of Bitcoin Cash, Bitcoin has taken off to new highs.

There will be countless other software changes across all cryptocurrencies, so make sure that you understand the implications of those changes.

Public Hype

Just like fake tweets can affect the price of a stock, any type of hype can affect the value of a cryptocurrency.Good or bad.

So before you dismiss something as just hype, remember that hype moves markets too. But if you do trade hype, be sure to close your trade out long before the hype has a chance to cool off.

Otherwise, it could be a very expensive lesson.

Wallet Improvements

Since you are reading this post, you probably want to start actively trading cryptocurrencies. But there are many other people who are investors and want to buy and hold for the next few years.This is where storage becomes an important part of the cryptocurrency valuation equation.

Unlike traditional fiat currency that can be stored in a bank, your trading account, or your mattress at home, cryptocurrencies need to have a compatible wallet (or cold storage solution) to be stored safely.

Remember that cryptocurrency is simply software. So the wallet software needs to be able to work with the cryptocurrency software.

It's like trying to use the Windows version of Microsoft Office on a Mac.

That simply won't work.

Therefore, if a cryptocurrency doesn't have a good wallet yet, that will prevent less technical investors from buying the currency.

But as soon as one is available, then it makes the currency much more accessible to the masses.

…and thus, more valuable.

If you find that a cryptocurrency does not have a good wallet solution yet, that could be one signal that it is undervalued.

Looking for opportunities to buy, immediately after the launch of the first high-quality wallet, could give you a nice short-term profit.

Platform Applications

Some cryptocurrency platforms, like Ethereum, host other applications. These applications, in turn, can have their own currencies or tokens.If one of these DApps or Decentralized Apps does very well, this can have a positive effect on the underlying platform currency.

The value of the tokens should theoretically be independent of the value of the platform.

However, not everyone understands this and the success of one DApp can drive the price of Ether…at least in the short term.

So if you are trading a platform cryptocurrency, watch promising apps on the platform closely.

Government Regulation

Finally, government regulation can have a huge effect on the value of a cryptocurrency.One example is in Venezuela, where the police have been arresting Bitcoin miners on made-up charges. This has forced miners to go underground or start mining Ether instead.

But this could happen in any country. Any decision by the NFA or SEC could affect the value of certain cryptocurrencies. The SEC has already banned certain Initial Coin Offerings (ICOs), due to the potential pump and dump situation that could happen with those coins.

Be aware of current trends in government regulation and steer clear of currencies that could get red flagged by government agencies.

Conclusion

So that is the Trading Heroes Beginner's Guide to Trading Cryptocurrencies. I hope that it answered any questions that you may have had about trading currencies like Bitcoin or Ether.There will be more detailed posts on specific currencies and how to do some of the things mentioned above.

If you have any more questions or comments, leave them below.

Happy Trading!

Disclaimer: Some links on this page are affiliate links. We do make a commission if you purchase through these links, but it does not cost you anything extra and we only promote products and services that we personally use and wholeheartedly believe in. A portion of the proceeds are donated to my charity partner.

Ref:https://www.tradingheroes.com/cryptocurrency-trading-guide-beginners/

Hashcoin mine

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange using cryptography to secure the transactions, to control the creation of additional units, and to verify the transfer of assets.[1][2][3] Cryptocurrencies are classified as a subset of digital currencies and are also classified as a subset of alternative currencies and virtual currencies.

Bitcoin, created in 2009, was the first decentralized cryptocurrency.[4] Since then, numerous cryptocurrencies have been created.[5] These are frequently called altcoins, as a blend of bitcoin alternative.[6][7][8] Bitcoin and its derivatives use decentralized control[9] as opposed to centralized electronic money/centralized banking systems.[10] The decentralized control is related to the use of bitcoin's blockchain transaction database in the role of a distributed ledger.[11]

As of September 2017, over a thousand cryptocurrency specifications exist; most are similar to and derived from the first fully implemented decentralized cryptocurrency, bitcoin. Within cryptocurrency systems the safety, integrity and balance of ledgers is maintained by a community of mutually distrustful parties referred to as miners: members of the general public using their computers to help validate and timestamp transactions adding them to the ledger in accordance with a particular timestamping scheme.[13] Miners have a financial incentive to maintain the security of a cryptocurrency ledger.

Most cryptocurrencies are designed to gradually decrease production of currency, placing an ultimate cap on the total amount of currency that will ever be in circulation, mimicking precious metals.[1][14] Compared with ordinary currencies held by financial institutions or kept as cash on hand, cryptocurrencies can be more difficult for seizure by law enforcement.[1] This difficulty is derived from leveraging cryptographic technologies. A primary example of this new challenge for law enforcement comes from the Silk Road case, where Ulbricht's bitcoin stash "was held separately and ... encrypted."[15] Cryptocurrencies such as bitcoin are pseudonymous, though additions such as Zerocoin have been suggested, which would allow for true anonymity.[16][17][18]

The first decentralized cryptocurrency, bitcoin, was created in 2009 by pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash function, as its proof-of-work scheme.[13][23] In April 2011, Namecoin was created as an attempt at forming a decentralized DNS, which would make internet censorship very difficult. Soon after, in October 2011, Litecoin was released. It was the first successful cryptocurrency to use scrypt as its hash function instead of SHA-256. Another notable cryptocurrency, Peercoin was the first to use a proof-of-work/proof-of-stake hybrid.[24] IOTA was the first cryptocurrency not based on a blockchain, and instead uses the Tangle.[25][26] Many other cryptocurrencies have been created though few have been successful, as they have brought little in the way of technical innovation.[27] On 6 August 2014, the UK announced its Treasury had been commissioned to do a study of cryptocurrencies, and what role, if any, they can play in the UK economy. The study was also to report on whether regulation should be considered.[28]

Central bank representatives have stated that the adoption of

cryptocurrencies such as bitcoin pose a significant challenge to central

banks' ability to influence the price of credit for the whole economy.[29]

They have also stated that as trade using cryptocurrencies becomes more

popular, there is bound to be a loss of consumer confidence in fiat currencies.[30]

Gareth Murphy, a senior central banking officer has stated "widespread

use [of cryptocurrency] would also make it more difficult for

statistical agencies to gather data on economic activity, which are used

by governments to steer the economy". He cautioned that virtual

currencies pose a new challenge to central banks' control over the

important functions of monetary and exchange rate policy.[31]

Central bank representatives have stated that the adoption of

cryptocurrencies such as bitcoin pose a significant challenge to central

banks' ability to influence the price of credit for the whole economy.[29]

They have also stated that as trade using cryptocurrencies becomes more

popular, there is bound to be a loss of consumer confidence in fiat currencies.[30]

Gareth Murphy, a senior central banking officer has stated "widespread

use [of cryptocurrency] would also make it more difficult for

statistical agencies to gather data on economic activity, which are used

by governments to steer the economy". He cautioned that virtual

currencies pose a new challenge to central banks' control over the

important functions of monetary and exchange rate policy.[31]

Jordan Kelley, founder of Robocoin, launched the first bitcoin ATM in the United States on February 20, 2014. The kiosk installed in Austin, Texas is similar to bank ATMs but has scanners to read government-issued identification such as a driver's license or a passport to confirm users' identities.[32] By September 2017 1574 bitcoin ATMs were installed around the world with an average fee of 9.05%. An average of 3 bitcoin ATMs were being installed per day in September 2017.[33]

The Dogecoin Foundation, a charitable organization centered around Dogecoin and co-founded by Dogecoin co-creator Jackson Palmer, donated more than $30,000 worth of Dogecoin to help fund the Jamaican bobsled team's trip to the 2014 Olympic games in Sochi, Russia.[34] The growing community around Dogecoin is looking to cement its charitable credentials by raising funds to sponsor service dogs for children with special needs.[35]

On March 25, 2014, the United States Internal Revenue Service (IRS) ruled that bitcoin will be treated as property for tax purposes as opposed to currency. This means bitcoin will be subject to capital gains tax. One benefit of this ruling is that it clarifies the legality of bitcoin. No longer do investors need to worry that investments in or profit made from bitcoins are illegal or how to report them to the IRS.[38] In a paper published by researchers from Oxford and Warwick, it was shown that bitcoin has some characteristics more like the precious metals market than traditional currencies, hence in agreement with the IRS decision even if based on different reasons.[39]

Legal issues not dealing with governments have also arisen for cryptocurrencies. Coinye, for example, is an altcoin that used rapper Kanye West as its logo without permission. Upon hearing of the release of Coinye, originally called Coinye West, attorneys for Kanye West sent a cease and desist letter to the email operator of Coinye, David P. McEnery Jr. The letter stated that Coinye was willful trademark infringement, unfair competition, cyberpiracy, and dilution and instructed Coinye to stop using the likeness and name of Kanye West.[40]

Cryptocurrency networks display a marked lack of regulation that attracts many users who seek decentralized exchange and use of currency; however the very same lack of regulations has been critiqued as potentially enabling criminals who seek to evade taxes and launder money.

Transactions that occur through the use and exchange of these altcoins are independent from formal banking systems, and therefore can make tax evasion simpler for individuals. Since charting taxable income is based upon what a recipient reports to the revenue service, it becomes extremely difficult to account for transactions made using existing cryptocurrencies, a mode of exchange that is complex and (in some cases) impossible to track.[43]

Systems of anonymity that most cryptocurrencies offer can also serve as a simpler means to launder money. Rather than laundering money through an intricate net of financial actors and offshore bank accounts, laundering money through altcoins can be achieved through anonymous transactions.[43]

GBL, a Chinese bitcoin trading platform, suddenly shut down on October 26, 2013. Subscribers, unable to log in, lost up to $5 million worth of bitcoin.[45][46]

In February 2014, cryptocurrency made national headlines due to the world's largest bitcoin exchange, Mt. Gox, declaring bankruptcy. The company stated that it had lost nearly $473 million of their customer's bitcoins likely due to theft. This was equivalent to approximately 750,000 bitcoins, or about 7% of all the bitcoins in existence. Due to this crisis, among other news, the price of a bitcoin fell from a high of about $1,160 in December to under $400 in February.[47]

On March 31, 2015, two now-former agents from the Drug Enforcement Administration and the U.S. Secret Service were charged with wire fraud, money laundering and other offenses for allegedly stealing bitcoin during the federal investigation of Silk Road, an underground illicit black market federal prosecutors shut down in 2013.[48]

On December 1, 2015, the owner of the now-defunct GAW Miners website was accused of securities fraud following his development of the cryptocurrency known as Paycoin. He is accused of masterminding an elaborate ponzi scheme under the guise of "cloud mining" with mining equipment hosted in a data center. He purported the cloud miners known as "hashlets" to be mining cryptocurrency within the Zenportal "cloud" when in fact there were no miners actively mining cryptocurrency. Zenportal had over 10,000 users that had purchased hashlets for a total of over 19 million U.S. dollars.[49][50]

On August 24, 2016, a federal judge in Florida certified a class action lawsuit[51] against defunct cryptocurrency exchange Cryptsy and Cryptsy's owner. He is accused of misappropriating millions of dollars of user deposits, destroying evidence, and is believed to have fled to China.[52]

Darknet markets present growing challenges in regard to legality. Bitcoins and other forms of cryptocurrency used in dark markets are not clearly or legally classified in almost all parts of the world. In the U.S., bitcoins are labelled as "virtual assets". This type of ambiguous classification puts mounting pressure on law enforcement agencies around the world to adapt to the shifting drug trade of dark markets.[53]

Since most darknet markets run through Tor, they can be found with relative ease on public domains. This means that their addresses can be found, as well as customer reviews and open forums pertaining to the drugs being sold on the market, all without incriminating any form of user.[43] This kind of anonymity enables users on both sides of dark markets to escape the reaches of law enforcement. The result is that law enforcement adheres to a campaign of singling out individual markets and drug dealers to cut down supply. However, dealers and suppliers are able to stay one step ahead of law enforcement, who cannot keep up with the rapidly expanding and anonymous marketplaces of dark markets.[53]

Some other hashing algorithms that are used for proof-of-work include CryptoNight, Blake, SHA-3, and X11.

Modifications of the proof-of-work algorithm have been created to address the problem of scaling, such as the way the IOTA ledger works. IOTA uses a simplified Proof-of-work algorithm making use of directed acyclic graph.[56] A new transaction becomes part of the ledger after its sender does a small amount of proof-of-work. Each network participant is therefore also a miner.[56][57] This system scales automatically as it gets used more.[58]

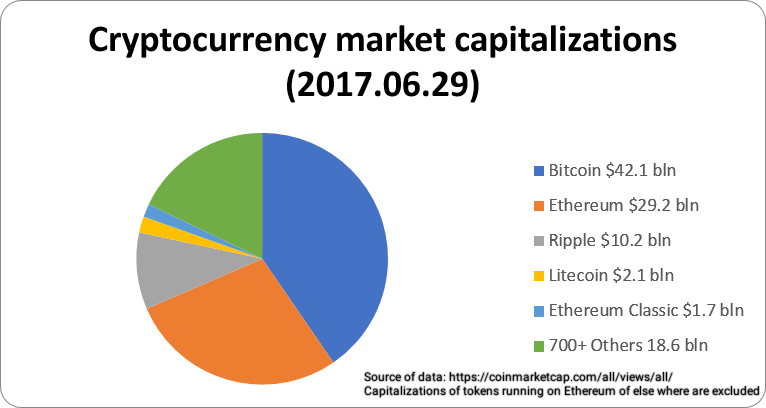

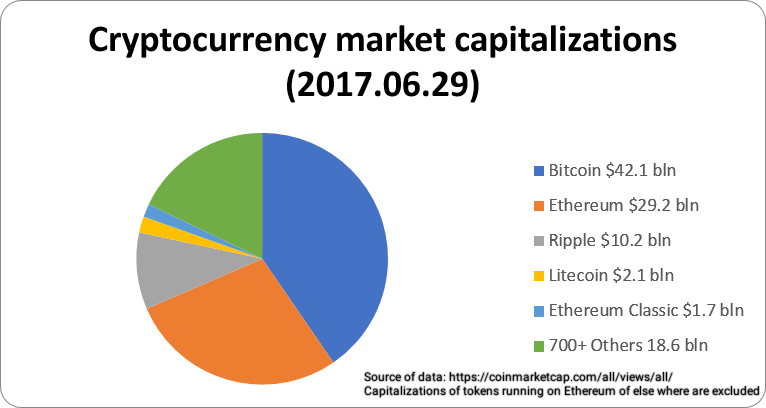

Cryptocurrencies are used primarily outside existing banking and

governmental institutions, and exchanged over the Internet. While these

alternative, decentralized modes of exchange are in the early stages of

development, they have the unique potential to challenge existing

systems of currency and payments. As of June 2017 total market

capitalization of cryptocurrencies is bigger than 100 billion USD and

record high daily volume is larger than 6 billion USD.[60]

Cryptocurrencies are used primarily outside existing banking and

governmental institutions, and exchanged over the Internet. While these

alternative, decentralized modes of exchange are in the early stages of

development, they have the unique potential to challenge existing

systems of currency and payments. As of June 2017 total market

capitalization of cryptocurrencies is bigger than 100 billion USD and

record high daily volume is larger than 6 billion USD.[60]

Cryptocurrency

Hashcoin mine

Nxt exchanges

Monero wallet on a mobilephone

This article has been nominated to be checked for its neutrality. (November 2017) (Learn how and when to remove this template message)

|

Bitcoin, created in 2009, was the first decentralized cryptocurrency.[4] Since then, numerous cryptocurrencies have been created.[5] These are frequently called altcoins, as a blend of bitcoin alternative.[6][7][8] Bitcoin and its derivatives use decentralized control[9] as opposed to centralized electronic money/centralized banking systems.[10] The decentralized control is related to the use of bitcoin's blockchain transaction database in the role of a distributed ledger.[11]

Contents

Overview

Decentralized cryptocurrency is produced by the entire cryptocurrency system collectively, at a rate which is defined when the system is created and which is publicly known. In centralized banking and economic systems such as the Federal Reserve System, corporate boards or governments control the supply of currency by printing units of fiat money or demanding additions to digital banking ledgers. In case of decentralized cryptocurrency, companies or governments cannot produce new units, and have not so far provided backing for other firms, banks or corporate entities which hold asset value measured in it. The underlying technical system upon which decentralized cryptocurrencies are based was created by the group or individual known as Satoshi Nakamoto.[12]As of September 2017, over a thousand cryptocurrency specifications exist; most are similar to and derived from the first fully implemented decentralized cryptocurrency, bitcoin. Within cryptocurrency systems the safety, integrity and balance of ledgers is maintained by a community of mutually distrustful parties referred to as miners: members of the general public using their computers to help validate and timestamp transactions adding them to the ledger in accordance with a particular timestamping scheme.[13] Miners have a financial incentive to maintain the security of a cryptocurrency ledger.

Most cryptocurrencies are designed to gradually decrease production of currency, placing an ultimate cap on the total amount of currency that will ever be in circulation, mimicking precious metals.[1][14] Compared with ordinary currencies held by financial institutions or kept as cash on hand, cryptocurrencies can be more difficult for seizure by law enforcement.[1] This difficulty is derived from leveraging cryptographic technologies. A primary example of this new challenge for law enforcement comes from the Silk Road case, where Ulbricht's bitcoin stash "was held separately and ... encrypted."[15] Cryptocurrencies such as bitcoin are pseudonymous, though additions such as Zerocoin have been suggested, which would allow for true anonymity.[16][17][18]

History

As early as October 3, 1996, Lin Hsin Hsin initiated the phenomena of digital currency titled e-money [19], first published in 1997, book titled In Bytes We travel [20] and make the currency crypto. In 1998, Wei Dai published a description of "b-money", an anonymous, distributed electronic cash system.[21] Shortly thereafter, Nick Szabo created "bit gold".[22] Like bitcoin and other cryptocurrencies that would follow it, bit gold (not to be confused with the later gold-based exchange, BitGold) was an electronic currency system which required users to complete a proof of work function with solutions being cryptographically put together and published. A currency system based on a reusable proof of work was later created by Hal Finney who followed the work of Dai and Szabo.The first decentralized cryptocurrency, bitcoin, was created in 2009 by pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash function, as its proof-of-work scheme.[13][23] In April 2011, Namecoin was created as an attempt at forming a decentralized DNS, which would make internet censorship very difficult. Soon after, in October 2011, Litecoin was released. It was the first successful cryptocurrency to use scrypt as its hash function instead of SHA-256. Another notable cryptocurrency, Peercoin was the first to use a proof-of-work/proof-of-stake hybrid.[24] IOTA was the first cryptocurrency not based on a blockchain, and instead uses the Tangle.[25][26] Many other cryptocurrencies have been created though few have been successful, as they have brought little in the way of technical innovation.[27] On 6 August 2014, the UK announced its Treasury had been commissioned to do a study of cryptocurrencies, and what role, if any, they can play in the UK economy. The study was also to report on whether regulation should be considered.[28]

Publicity

Central bank representatives have stated that the adoption of

cryptocurrencies such as bitcoin pose a significant challenge to central

banks' ability to influence the price of credit for the whole economy.[29]

They have also stated that as trade using cryptocurrencies becomes more

popular, there is bound to be a loss of consumer confidence in fiat currencies.[30]

Gareth Murphy, a senior central banking officer has stated "widespread

use [of cryptocurrency] would also make it more difficult for

statistical agencies to gather data on economic activity, which are used

by governments to steer the economy". He cautioned that virtual

currencies pose a new challenge to central banks' control over the

important functions of monetary and exchange rate policy.[31]

Central bank representatives have stated that the adoption of

cryptocurrencies such as bitcoin pose a significant challenge to central

banks' ability to influence the price of credit for the whole economy.[29]

They have also stated that as trade using cryptocurrencies becomes more

popular, there is bound to be a loss of consumer confidence in fiat currencies.[30]

Gareth Murphy, a senior central banking officer has stated "widespread

use [of cryptocurrency] would also make it more difficult for

statistical agencies to gather data on economic activity, which are used

by governments to steer the economy". He cautioned that virtual

currencies pose a new challenge to central banks' control over the

important functions of monetary and exchange rate policy.[31]Jordan Kelley, founder of Robocoin, launched the first bitcoin ATM in the United States on February 20, 2014. The kiosk installed in Austin, Texas is similar to bank ATMs but has scanners to read government-issued identification such as a driver's license or a passport to confirm users' identities.[32] By September 2017 1574 bitcoin ATMs were installed around the world with an average fee of 9.05%. An average of 3 bitcoin ATMs were being installed per day in September 2017.[33]

The Dogecoin Foundation, a charitable organization centered around Dogecoin and co-founded by Dogecoin co-creator Jackson Palmer, donated more than $30,000 worth of Dogecoin to help fund the Jamaican bobsled team's trip to the 2014 Olympic games in Sochi, Russia.[34] The growing community around Dogecoin is looking to cement its charitable credentials by raising funds to sponsor service dogs for children with special needs.[35]

Legality

The legal status of cryptocurrencies varies substantially from country to country and is still undefined or changing in many of them. While some countries have explicitly allowed their use and trade, others have banned or restricted it. Likewise, various government agencies, departments, and courts have classified bitcoins differently. China Central Bank banned the handling of bitcoins by financial institutions in China during an extremely fast adoption period in early 2014.[36] In Russia, though cryptocurrencies are legal, it is illegal to actually purchase goods with any currency other than the Russian ruble.[37]On March 25, 2014, the United States Internal Revenue Service (IRS) ruled that bitcoin will be treated as property for tax purposes as opposed to currency. This means bitcoin will be subject to capital gains tax. One benefit of this ruling is that it clarifies the legality of bitcoin. No longer do investors need to worry that investments in or profit made from bitcoins are illegal or how to report them to the IRS.[38] In a paper published by researchers from Oxford and Warwick, it was shown that bitcoin has some characteristics more like the precious metals market than traditional currencies, hence in agreement with the IRS decision even if based on different reasons.[39]

Legal issues not dealing with governments have also arisen for cryptocurrencies. Coinye, for example, is an altcoin that used rapper Kanye West as its logo without permission. Upon hearing of the release of Coinye, originally called Coinye West, attorneys for Kanye West sent a cease and desist letter to the email operator of Coinye, David P. McEnery Jr. The letter stated that Coinye was willful trademark infringement, unfair competition, cyberpiracy, and dilution and instructed Coinye to stop using the likeness and name of Kanye West.[40]

The legal concern of an unregulated global economy

As the popularity of and demand for online currencies has increased since the inception of bitcoin in 2009,[41][42] so have concerns that such an unregulated person to person global economy that cryptocurrencies offer may become a threat to society. Concerns abound that altcoins may become tools for anonymous web criminals.[43]Cryptocurrency networks display a marked lack of regulation that attracts many users who seek decentralized exchange and use of currency; however the very same lack of regulations has been critiqued as potentially enabling criminals who seek to evade taxes and launder money.

Transactions that occur through the use and exchange of these altcoins are independent from formal banking systems, and therefore can make tax evasion simpler for individuals. Since charting taxable income is based upon what a recipient reports to the revenue service, it becomes extremely difficult to account for transactions made using existing cryptocurrencies, a mode of exchange that is complex and (in some cases) impossible to track.[43]

Systems of anonymity that most cryptocurrencies offer can also serve as a simpler means to launder money. Rather than laundering money through an intricate net of financial actors and offshore bank accounts, laundering money through altcoins can be achieved through anonymous transactions.[43]

Fraud

On August 6, 2013, Magistrate Judge Amos Mazzant of the Eastern District of Texas federal court ruled that because cryptocurrency (expressly bitcoin) can be used as money (it can be used to purchase goods and services, pay for individual living expenses, and exchanged for conventional currencies), it is a currency or form of money. This ruling allowed for the SEC to have jurisdiction over cases of securities fraud involving cryptocurrency.[44]GBL, a Chinese bitcoin trading platform, suddenly shut down on October 26, 2013. Subscribers, unable to log in, lost up to $5 million worth of bitcoin.[45][46]

In February 2014, cryptocurrency made national headlines due to the world's largest bitcoin exchange, Mt. Gox, declaring bankruptcy. The company stated that it had lost nearly $473 million of their customer's bitcoins likely due to theft. This was equivalent to approximately 750,000 bitcoins, or about 7% of all the bitcoins in existence. Due to this crisis, among other news, the price of a bitcoin fell from a high of about $1,160 in December to under $400 in February.[47]

On March 31, 2015, two now-former agents from the Drug Enforcement Administration and the U.S. Secret Service were charged with wire fraud, money laundering and other offenses for allegedly stealing bitcoin during the federal investigation of Silk Road, an underground illicit black market federal prosecutors shut down in 2013.[48]

On December 1, 2015, the owner of the now-defunct GAW Miners website was accused of securities fraud following his development of the cryptocurrency known as Paycoin. He is accused of masterminding an elaborate ponzi scheme under the guise of "cloud mining" with mining equipment hosted in a data center. He purported the cloud miners known as "hashlets" to be mining cryptocurrency within the Zenportal "cloud" when in fact there were no miners actively mining cryptocurrency. Zenportal had over 10,000 users that had purchased hashlets for a total of over 19 million U.S. dollars.[49][50]

On August 24, 2016, a federal judge in Florida certified a class action lawsuit[51] against defunct cryptocurrency exchange Cryptsy and Cryptsy's owner. He is accused of misappropriating millions of dollars of user deposits, destroying evidence, and is believed to have fled to China.[52]

Darknet markets