Why invest in Myanmar?

Growing in a growing economy....

DICA warmly invites responsible investors

to pursue business opportunities that help grow and shape the “New

Myanmar” and accelerate the realization of national development goals

through sustainable economic development on a countrywide scale.

- Myanmar’s economy has continuously grown at

approximately 8% since 2012. Over FY 2014-15, a GDP increase of 8.7% has

been mainly driven by developments and investments in the

telecommunication sector (57.5%*), extractive industries (50.5%*), oil

and gas (36.1%*), construction (15.9%*), manufacturing (9.7%*) as well

as growth in key service industries (e.g. tourism). (*=percentage

increase of the absolute GDP contribution of the sector)

- Myanmar’s overall growth strategy is built on a

complementary mix of policies to simultaneously enable modernization in

industry, agriculture and infrastructure, a diversification of the

export basis and the expansion of value-added production for domestic

and international markets.

- Three costal Special Economic Zones in Thilawa,

Kyaukphyu and Dawei with particular investment incentives, simplified

processes for investors and industrial facilities at international

standards will become “growth engines” of the New Myanmar.

In addition, growth along economic corridors with old (Yangon and Mandalay) and new development nodes (e.g. Bago, Hpa An, Sittwe, Myitkyina and border towns) is fostered.

- Economic growth has led to the emergence of an increasing middle class and a significant increase in per-capita consumption of 10.9% (during FY 2013-14). Increasing opportunities open up for the FMCG industry and service industries (e.g. private education institutions, entertainment).

Location & Connectivity: Shaping Asia’s new crossroads

Myanmar is in an excellent position to

access to regional and global factor markets as well as product markets.

Improvements in Myanmar’s infrastructure (in terms of particularly

power infrastructure, road, rail, air and ports) have highest priority

by the Government in order to establish efficient national and

international supply chains for future economic growth.

- Myanmar is the largest country of mainland

Southeast Asia and has – beyond its domestic market of more than 50

million citizens – direct access to China, India, ASEAN markets and

other international markets through ports along the Bay of Bengal and

Andaman Sea.

- After decades of international isolation

prevented the modernization and expansion of infrastructural networks,

the Government of Myanmar is now in the preparation for building the

physical “roads” to becoming Asia’s “crossroads” through investments

into

- major domestic highways and transnational road links to Thailand (i.e. from Hpa An and Dawei SEZ), China (i.e. from Mandalay) and India (i.e. from Mandalay and the Kaladan Multi-Modal Transit Transport Project),

- a more modern rail network and dry port facilities in Ywarthargyi (near Yangon) and Myitnge (near Mandalay) and

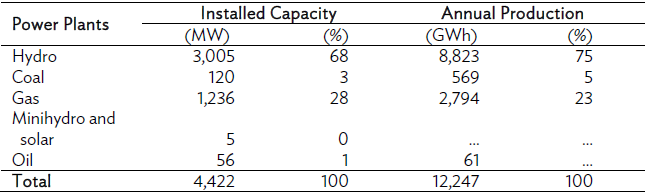

- power infrastructure to expand installed capacity (4,422 MW in 2014)

and annual production (12,247 GWh) as well as the transmission system

according to the National Electrification Plan foreseeing an full

electrification even of remote areas by 2030.

- Myanmar will be increasingly integrated into regional production networks through its membership in the ASEAN Economic Community as well as the ASEAN-China Free Trade Area (ACFTA), while internationally enjoying preferential tariff schemes as a least developed country (LDC).

Supporting the reforms course of the “New Myanmar”

Myanmar is undergoing a fundamental

political and economic transformation to a democratic, federal and

peaceful national state. Responsible investments are key requirements

for and direct drivers of sustainable and inclusive economic

development.

- A National Comprehensive Development Plan

(NCDP) has been formulated to identify policy directions for countrywide

sustainable economic development in based on international best

practices to alleviate poverty in the country.

- A sector-specific National Export Strategy (NES)

is under implementation to strengthen trade and investment in

high-potential industries with strong global demand (e.g. rice, textiles

and garments, tourism). Myanmar as a least developed country (LDC) is

enjoying preferential tariff arrangements to facilitate the access of

the country to major international markets.

- The Government of Myanmar is highly committed to

encouraging investments with a positive impact on society and

environment. Investment activities in certain sectors are therefore

prohibited or restricted or may require specific approvals, processes,

joint venturing or Environmental and Social Impact Assessments (EIA/SIA)

to avoid adverse impacts on communities and their livelihoods, the

environment as well as the progress in peace and national

reconciliation.

- DICA is warmly inviting foreign companies to invest in less developed parts of Myanmar and to consider business opportunities facilitating the economic inclusion of Myanmar citizens in remote parts of the country (e.g. Chin State).

Investing in(to) the Myanmar society

Myanmar has the right “ingredients” and

potentials for sustainable growth: The country offers natural resources

and arable land in abundance – most importantly, however, Myanmar

possesses a skilled, motivated and young population to realize the

potentials and positive change.

- In the previous years of political and

economic reform, the Myanmar society has shown to be willing and capable

to drive the fundamental change. Myanmar’s citizens have demonstrated

to be flexible in adapting to the availability of new opportunities and

in dealing with new technology (the so called “digital leapfrogging of

Myanmar”) and requirements, while acquiring new skills and competencies

in a learning society – as employees and entrepreneurs.

- Particularly in Yangon and increasingly in urban

centres in all of Myanmar, traditional life and modernity mix

harmoniously – the society is open, warm and welcoming to foreign

cultures and influence.

- According to the Myanmar Population and Housing

Census (2014), Myanmar is home to 51.4 million people – a young

population with a share of 65.6% within working age (15-64 years).

- The population is generally well educated with a

high literacy rate of 93% and widely spread basic competences in

English. Vocational training programs through the private sector may

therefore easily close skill gaps.

- Valuable efforts are being made to strengthen the education sector in Myanmar: Compared to 2012, public spending in education in 2014 has increased by 49%. In addition, the Government is leading a Comprehensive Education Sector Review (CESR) to better understand the current status of education and is developing a National Education Sector Plan (NESP), which will guide the implementation of policies and programmes.

Profiting from a liberal, transparent and business-enabling environment

The creation of a business-enabling

environment, investment promotion and protection are key priorities of

the Government of Myanmar to attract responsible investment.

- Several Bilateral Investment Treaties (BITs)

and other International Investment Agreements (IIAs) have been concluded

to date. Please find an updated list here.

- Agreements on the avoidance of double taxation

are in place with eight countries such as India, Laos, Malaysia, Korea,

Singapore, Thailand, United Kingdom and Vietnam.

- Various laws have been revised to facilitate

investment and to ease the operation of businesses in Myanmar, such as

the e.g. Foreign Investment Law (granting taxation benefits, land use

rights etc.), the Myanmar Citizen Investment Law and the Arbitration

Law. Further legal changes to a better business-enabling environment are

currently in the making (e.g. Banks and Financial Institutions Law of

Myanmar and a combined Myanmar Investment Law).

- A “National Framework for Public-Private

Partnerships” (PPP) is being prepared to accelerate growth and faster

improvements through the effective engagement of the private sector e.g.

in infrastructure development. Transparent procedures in public tenders

will be put in place to allow cost-efficient public service provision

and modernization.

- The transformation of the telecommunications industry in Myanmar from a monopoly into an open market and first competitive tender processes (such as for a gas-fired power plant in Myingyan, Mandalay Region) show the efforts of the Government to create an open and transparent business environment.

| State/Region |

Total

Population

|

Average Population

(%)

|

State/Region

urban population

|

| Yangon Region |

7,360,703

|

14.6

|

70.1

|

| Ayeyarwady Region |

6,184,829

|

123

|

14.1

|

| Mandalay Region |

6,165,723

|

12.3

|

34.8

|

| Shan State |

5,824,432

|

11.6

|

24.0

|

| Sagaing Region |

5,325,347

|

10.6

|

17.1

|

| Bago Region |

4,867,373

|

9.7

|

22.0

|

| Magway Region |

3,917,055

|

7.8

|

15.0

|

| Rakhine State |

2,098,807

|

4.2

|

16.9

|

| Mon State |

2,054,393

|

4.1

|

27.9

|

| Kachin State |

1,642,841

|

3.3

|

36.1

|

| Kayin State |

1,504,326

|

3.0

|

21.9

|

| Tanintharyi Region |

1,408,401

|

2.8

|

24.0

|

| Nay Pyi Taw |

1,160,242

|

2.3

|

32.3

|

| Chin State |

478,801

|

1.0

|

20.8

|

| Kayar State |

286,627

|

0.6

|

25.3

|

| Total |

50,279,900

|

100.0%

|

29.6%

|

Investment Opportunities

The

Government of the Republic of the Union of Myanmar warmly invites

responsible investors to seek and seize business opportunities in

Myanmar to accelerate sustainable economic growth.

Seize Investment Opportunities in Myanmar …

… in AGRICULTURE

… in AGRICULTURE

Myanmar is a agro-based country with a vast

potential of fertile land and abundant water resources. In 2014-15 a

total area of 11.379 million hectares had been used for agriculture (net

area sown). Given the landscape profile, topographic dimensions of

Myanmar and different climatic areas in Myanmar, not only perennial

plants, but also crops such as rice, pulses and beans, fruits and

vegetables can be easily grown.

DICA is aiming at attracting responsible local and

foreign investors, transforming the mostly traditional agricultural

economy of today into a productive and sustainable agro-economy. To

achieve this goal, increases in agricultural productivity (e.g. better

irrigation, better seeds and techniques) and quality (e.g. seed quality,

immediate post-harvest processing) are required.

Key opportunities:

- Agricultural input industries:

- Distribution of low-cost irrigation systems to rural communities (e.g. solar-powered, with instruction)

[Media: DICA_Investment_Opportunities_Irrigation] - Leasing of agricultural tools and machinery

- Distribution of high-quality seeds for higher yields (e.g. rice unification in cooperation with the Myanmar Agricultural Bank to incentive conversion of communities to agriculture with higher productivity levels)

- Establishment of the production of fertilizers, crop protection chemicals etc.

- Distribution of low-cost irrigation systems to rural communities (e.g. solar-powered, with instruction)

- Product and market development:

- Contract farming (i.e. direct sourcing from rural communities (based on partnership agreements)

- Introducing value-added production / processing based on local

agricultural produce (e.g. groundnut, sesame). Please find a list of

selected crops and annual production below:

[Media: DICA_Investment_Opportunities_Agricultural_Crops] - Establish packaging / canning industry for agricultural produce

- Agriculture-related services:

- Establishment of research and training institutions or demonstration farms on integrated agriculture, crop sequencing, fertilizer use, organic agriculture and agriculture-related business skill development

- Construction of warehouses and cold storages

- Microfinance, microinsurance and trade finance services for farmers

Seize Investment Opportunities in Myanmar …

… in AQUACULTURE & FISHERIES

… in AQUACULTURE & FISHERIES

Given Myanmar’s 2,832 kilometers of coastline

along the Bay of Bengal and in the Andaman Sea, fisheries represent – as

a natural matter of fact – an important opportunity for communities and

businesses in the coastal areas of Myanmar (particularly in Rakhine

State). Fishing grounds in Myanmar water are relatively less exploited

than elsewhere. The aquaculture sector is operating almost 50,000

hectares of freshwater ponds.

According to statistics of the Department of

Fisheries of the Ministry of Livestock, Fisheries and Rural Development,

the production of fish and seafood has nearly increased to an eightfold

between 1994 and 2014 demonstrating the importance of the sector to the

economy as well as its strong potentials. Opportunities in the sector

exist inshore (e.g. fish ponds, inland river systems and aquaculture),

offshore as well as at deepsea locations.

Foreign investment in the fisheries sector is

permitted to foreign investors in a joint venture with a local company.

Recently, fishery products from Myanmar received approval to be exported

to the European Union by certified producers. Myanmar enjoys

preferential tariff arrangements with the European Union as a least

developed country (LDC).

Key opportunities:

- Capture and aquaculture of different types of fish

- Capture and aquaculture of shrimp and prawn

- Fish food production

- Fish and seafood processing facilities

- Cooling, canning and packaging facilities

- Establishment of education and research institutions to broaden knowledge as well as the base of human resources available to the fisheries sector

Seize Investment Opportunities in Myanmar …

… through URBANIZATION

… through URBANIZATION

Likewise to other economies, Myanmar is

experiencing a gradual migration process of population from rural to

urban areas of Myanmar driven by a more diverse set of educational,

professional and income opportunities. Hand-in-hand with urbanization

come challenges as well as opportunities for local and foreign

businesses addressing these needs and finding durable solutions for

better and smarter cities in a more livable and a sustainable

environment.

Changed demand patterns of the rapidly growing

middle and consumer class open up new opportunities for the distribution

of a larger spectrum of consumer goods (e.g. FMCG) as well as an

emergence of new service industries (e.g. restaurants, entertainment,

education).

Key opportunities:

- Real Estate& Construction:

- Realization of projects for affordable housing in Yangon, Mandalay and second-tier cities in all states and regions

- Nearly 20,000 low-cost and affordable apartments are planned only in Yangon, Pathein and Mawlamyine in FY 2015-16. Demand is to increase rapidly.

- Restauration of colonial heritage buildings in Downtown Yangon

- Realization of projects for affordable housing in Yangon, Mandalay and second-tier cities in all states and regions

- Urban solutions:

- Investments into systems for the improvement of public transport in urban agglomerations

- Establishment of parks, facilities for recreation and entertainment

- Provision of private healthcare facilities

- Establishment of private education institutions (e.g. private universities, business schools, certified vocational training)

- Smart traffic management and road safety solutions

- Urban waste management

- Water treatment facilities

- Production and distribution of consumer goods and lifestyle articles

Seize Investment Opportunities in Myanmar …

… in TOURISMAND HOSPITALITY

… in TOURISMAND HOSPITALITY

The tourism and hospitality sector in Myanmar is

evolving rapidly since the political and economic opening of the country

– the number of visitors to the country has been growing nearly

exponentially since 2011:

TABLE: International tourist arrivals (including air, sea and road)

Year

|

Total

|

1995-1996

|

208,228

|

2000-2001

|

438,480

|

2005-2006

|

653,549

|

2010-2011

|

792,738

|

2011-2012

|

866,989

|

2012-2013

|

1,339,442

|

2013-2014

|

2,247,117

|

2014-2015

|

3,443,009

|

Source: Ministry of Hotels and Tourism, Ministry of Immigration and Population

At the moment, foreign tourists (on their first

short-term visit to Myanmar) mostly visit Yangon, Bagan, Inle Lake /

Nyaung Shwe as well as Mandalay. However, Myanmar offers to date

unexplored treasures of natural beautyin the whole of the country from

Kawthaung in the tropical South-East to Putao in the Himalaya.

The table displays the current distribution of

hotels, motels and inns/guesthouses in Myanmar and reflects the

considerable under capacity of available accommodation in numerous

locations outside of the urban centers Yangon and Mandalay. There is a

need for both, affordable as well as high-class accommodation depending

on the current demand.

TABLE: Distribution of available capacity of

hotels, motels, inns/guesthouses (in FY 2014-15; including private

owned, state-owned and cooperative-owned establishments)

State / Region

|

No. of hotels, motels and inns

|

No. of rooms

|

No. of beds

|

Kachin State

|

26

|

732

|

1445

|

Kayah State

|

8

|

175

|

350

|

Kayin State

|

11

|

346

|

692

|

Chin State

|

4

|

40

|

69

|

Sagaing Region

|

23

|

724

|

1426

|

Tanintharyi Region

|

27

|

1226

|

2385

|

Bago Region

|

50

|

1212

|

2325

|

Magway Region

|

28

|

598

|

1185

|

Mandalay Region

|

356

|

15053

|

30045

|

Mon State

|

39

|

1392

|

2784

|

Rakhine State

|

43

|

1303

|

2616

|

Yangon Region

|

301

|

14053

|

28072

|

Shan State

|

232

|

7015

|

13914

|

Ayeyarwaddy Region

|

64

|

2387

|

4703

|

Nay Pyi Taw

|

2

|

70

|

102

|

TOTAL

|

1214

|

46326

|

92113

|

Source: Ministry of Hotels and Tourism and Ministry of Cooperatives

Foreign investors may engage independently in

hotel developments of 3-stars or higher standard, whereby local

investors are encouraged also to consider opportunities in offering

budget accommodation through guesthouses at international standards. For

foreign companies, investments in tour companies, travel agencies,

budget hotels, amusement parks and tourism-related public infrastructure

projects are permitted on a joint-venture basis.

Key opportunities:

- Exploring new high-potential investment locations in hospitality and tourism

- Developing eco-tourism (e.g. development of eco-tourism oriented hotels and lodges along with respective activities such as trekking routes or tours)

- Building cultural and community-based tourism (e.g. development of shops for the sale of locally produced cultural artifacts)

Seize Investment Opportunities in Myanmar …

… in the POWER SECTOR

… in the POWER SECTOR

The power sector of Myanmar opens up abundant and

immediate opportunities to foreign and local investors. The installation

of considerable additional capacity to the current 4,422 MW as well as

the rapid construction of transmission lines are national priorities. In

order to reach the objective of full national electrification until

2030, the power sector of Myanmar is to grow to a multiple of its

current size.

The abundance of locations suitable for hydropower

generation, the available rich natural gas deposits and nearly

unexplored potentials in solar power and wind power along with the

expansion of the transmission system open miscellaneous investment

potentials. In the medium run, Myanmar may even develop to a net

exporter of electricity to neighboring countries.

Beyond 92 identified larger-scale hydropower

development (for the future development of potentially additional 46.1

GW) along the Ayeyarwaddy, Sittaung, Salween and Chindwin River systems,

also smaller-scale hydro power plants as well as other sources of

energy (i.e. solar, wind, gas) have high potential to play a significant

role for national power supply.

Key opportunities:

- Construction of medium to large-scale hydro and gas-fired power plants in Public-Private-Partnerships

- Investments into the transmission system (e.g. high-voltage transmission lines between the North of Myanmar and Yangon)

- Realization of small-scale hydro-power projects e.g. to supply a village tract

- Establishment of solar energy farms and wind power farms

- Provision of efficient and practical solar-power kits to communities currently off-grid as well as of solar-power based solutions (e.g. solar-powered pumps, solar lighting)

- Upgrading of the current power infrastructure in urban centers and industrial zones

Seize Investment Opportunities in Myanmar …

… in MANUFACTURING

… in MANUFACTURING

The manufacturing sector opens up opportunities

due to the significant domestic market of Myanmar, direct access to

strategic markets of Southeast Asia (ASEAN Economic Community) as well

as to China and India. Preferential tariff arrangements for exports of

the least developed country Myanmar to various geographies (e.g.

European Union, Japan) create distinct economic incentives for

investments in Myanmar.

With comparatively low labor costs, rich natural

resource endowments, a diverse agricultural base for further value-added

production and the strong support of industrial investment as a

priority of the Government of Myanmar, investors enjoy favorable

conditions.

To facilitate investments in manufacturing, three

Special Economic Zones (SEZ) in Thilawa (near Yangon), Dawei in

Myanmar’s Southeastern Tanintharyi Region as well as Kyaukphyu in

Rakhine State are currently under development along with a separate

legal framework granting investment incentives to companies in these

SEZ. Thilawa started its operation in 2015 as the first SEZ of Myanmar.

In addition to the SEZ, numerous industrial zones

have been established throughout the country, i.e. 14 industrial zones

in Yangon Region (e.g. Mingaladon Industrial Park), Mandalay, Monywa,

Hpa An, Kalay, Shwebo, Myingyan, Meikhtila, Magway, Pakhokku,

Yenanchaung, Taunggyi, Pyay, Mawlamyine, Pathein, Myaungmya, Hinthada

and Myeik.

Key opportunities:

- Value chain integration (e.g. joint ventures)

of companies of supportive industries from Myanmar with international

companies to combine operational experience in Myanmar with

international markets, technology and investment capital.

- Investment are in particular encouraged in the following industries:

- labor-intensive industries in second-tier cities (e.g. Pathein, Bago, Hpa An) in areas such as production of garments and shoes or assembling of toys and stationary articles

- agro-processing industries at the locations of agricultural produce in rural areas (see section on agriculture)

- production of building materials strongly demanded by the national construction industry (e.g. cement, bricks, steel, glass, paints, doors, windows etc.)

- gemstone processing industries (e.g. jade, sapphires, rubies) to establish value-adding production such as design, cutting and polishing inside Myanmar

- capital-intensive industries (e.g. automotive, land machinery) particularly at locations with good access to international and national markets (e.g. SEZs)

- wood-processing industry particularly based on hardwood and bamboo (e.g. furniture production)

- paper and cardboard industry

- high-tech industries (e.g. in Yangon, Nay Pyi Taw, Bago and Mandalay) based on local, regional and global demand and the opportunities through the proximity of international airports

- chemical industries (e.g. pharmaceutical and plastic articles) based on local and regional demand

- industrial services, e.g. waste water management, recycling, training

Seize Investment Opportunities in Myanmar …

… in INFRASTRUCTURE DEVELOPMENT

… in INFRASTRUCTURE DEVELOPMENT

The development of sufficient and better

infrastructure is an important requirement to be able to physically

carry the industrial and agricultural growth in Myanmar’s dynamic

future. As stipulated in the National Comprehensive Development Plan,

the Government prioritizes infrastructural and economic development

along certain major trade paths through the country in order to

facilitate the integration of Myanmar into production networks of the

Greater Mekong Subregion (GMS) and Myanmar’s Western neighbors.

The Government of Myanmar has experience in

conducting infrastructural projects under Build-Operate-Transfer (BOT)

or other Public Private Partnerships (PPP)agreements with the private

sector (e.g. in the railway and highway sector) and is welcoming

investors for infrastructural improvement projects.

Key opportunities:

- Road, bridge and railway construction

- Construction and operation of airports

- Construction of ports

- Establishment and retrofitting of industrial parks and supportive infrastructure

- Logistics infrastructure

Seize Investment Opportunities in Myanmar …

…in EXTRACTIVE INDUSTRIES (Minerals / Oil and Gas)

…in EXTRACTIVE INDUSTRIES (Minerals / Oil and Gas)

Myanmar possesses natural resources in abundance, such as predominantly the following minerals:

Alum

Amber Antimony Barite Bauxite Beryl Bismuth Cadmium Chromite Cinnebar Coal Cobalt |

Columbite

Copper Corundum Gemstones Gold Graphite Gypsum Iridium Iron ores Jadeite Kaolin Lead |

Manganese

Mica Molybdenum Natural gas Nickel Ochre Oil Oil shale Phosphates Platinum Salt Saltpetre |

Silver

Soda Steatite Sulphates Sulphides Sulphur Tin Titanium Tungsten Zinc |

The Government of Myanmar is encouraging

responsible investments in the field of the extractive industries.

Investors may support the exploration and extraction of the natural

resources according to international best practices. Responsible

investments in extractive industries are necessarily to consider the

implications on livelihoods of the local population, the environment,

societal factors as well as the political economy in specific areas.

Myanmar is a candidate of the Extractive Industries Transparency

Initiative.

Key opportunities:

- Exploration and feasibility studies for projects in mining as well as oil and gas

- Medium to Large-scale operation of mines and wells

- Offshore and onshore opportunities for the exploration and extraction of oil and gas

- Establishment of petroleum-based industrial, processing and supportive facilities (e.g. refineries, fertilizers, LPG, LNG)

- Value-added production based on natural resources

- Supporting industries, such as machinery, maintenance, consulting services

- Establishment of education and research institutions to broaden knowledge as well as the base of human resources available to this sector

Seize Investment Opportunities in Myanmar …

… in FORESTRY-BASED INDUSTRIES

… in FORESTRY-BASED INDUSTRIES

Myanmar’s strong forestry sector offers numerous

opportunities for involvement of local and international investors. The

country is one of the leading producers of teak and hardwood

(particularly Pyinkadoe and Padauk).

In order to prevent the continuation of

unsustainable forestry practices and large scale log-harvesting

particularly of teak, the Government of Myanmar strictly and effectively

abandoned the export of unprocessed teak and hardwood in April 2014.

According to the Department of Forestry, between 2000 and 2014, the

total forest cover of Myanmar decreased from 348,680 sq-km to 304,725

sq-km equaling anaverage deforestation rate of approximately 1%.The ban

on logging has proven to be effective in incentivizing more value-added

production in wood-processing in Myanmar and increasing the GDP

contribution of this sector.

The structural change offers opportunities to

foreign and local investors to support this emergence of value-added and

sustainable forestry e.g. by establishing new wood-processing

industries in Myanmar. Furthermore, the stronger engagement of the

private sector in the plantation business to restore forests in an

environmentally and economically sustainable way is desired.

Key opportunities:

- Establishment of wood-processing industry (e.g. furniture production)

- Expansion of bamboo forests and bamboo-based production (i.e. handicrafts)

- Rubber-based industries (e.g. tire production in Mon and Karen State)

- Teak and hardwood plantations

- Sandalwood-processing industries

- Community-based forestry

Table: Tree species in Myanmar in 2000 and 2005

Source: European Union

No comments:

Post a Comment